This is the second of a two-part series on the history and predatory policies of the student loan industry. This specialized wing of the finance industry is bankrupting a generation, unabashedly profiteering from the determination of young people to learn, be productive and secure a college degree.

Speculating on college loans—Sallie Mae goes public

In 1995, the Student Loan Marketing Association (Sallie Mae) began the transition to a profit-based operation. This process is documented by The Student Loan Scam. Between 1997 and 2006, Sallie Mae’s holdings grew from $45 billion to $123 billion, as the cost of college skyrocketed. In a five-year period, its stock increased by nearly 1,700 percent. The company set aside, according to the Securities and Exchange Commission, $3.6 billion for stock bonuses in 2005.

Under threat from the nonprofit Direct Loan Program signed into law during the Clinton administration, SLM began marketing its loan products directly to students. Because it was so well known and easily mistaken as a non-profit, Sallie Mae was in an unusually well-placed position to expand its operations.

It signed up colleges to “school-as-lender” programs and secured places on schools’ “preferred vendor” lists. Universities made money on their students’ loans if they went through Sallie Mae, and the lender began courting financial aid officers with trips, parties and various other additional inducements.

College kickbacks were small potatoes, however, compared to the millions of dollars Sallie Mae spent lobbying Congress in the 1990s. Collinge demonstrates that its efforts paid off. In 1998, Congress approved legislation that allowed for massive penalties and fees for delinquent student loans, legislation that actually made it more profitable for the lenders and guarantors when students defaulted than when they paid. The 1998 amendment to the Higher Education Act provided for collection rates of up to 25 percent to be applied to the debt.

“This meant,” Collinge writes, “that when borrowers defaulted on their loans, guarantors could take a quarter of every dollar the borrowers eventually repaid, money that would not be applied to the principal and interest on the debts, which the borrowers had been unable to afford to repay in the first place. This massive, unearned revenue stream going to the guarantors and to the collection agencies they contract with (agencies that are often owned by the original lenders) has not surprisingly led to usurious situations.”

What is a guarantor? It is a type of fiduciary organization created by the Higher Education Act of 1965 to share risk, alongside the federal government, as a “guarantor” of student loans. However, in practice, Collinge says, they don’t. They receive government funding for undefined “oversight” but confine their work to attaching massive penalties and fees to defaulted loans and then passing them along to collection agencies they might, or might not, own.

Around 2000, Sallie Mae purchased two of the nation’s largest student loan guarantors, USA Group and Southwest Student Services. These guarantors have created another level of million-dollar executives overseeing operations with a captive clientele.

Sallie Mae also went on to purchase the student loan collection companies, so that by 2006 it dominated all aspects of the student loan industry. Sallie Mae has been sued for its unique position as both a lender and a collector. According to CBS News, in 2005 nearly a fifth of its revenue came from collection agencies. Collinge points out that its fee income increased by 228 percent between 2000 and 2005, from $280 million to $920 million, while its stock price increased 1,600 percent in the decade of 1995 to 2005.

In 2005, Sallie Mae was named by Fortune as the second most profitable company in the US (Microsoft was 18th that year), with its CEO Albert Lord the highest-paid CEO in Washington, D.C., that year. In 2007, the New York Times estimated Lord’s holdings in the company at $450 million. In 2008, he received $4.7 billion in compensation, according to the Washington Post.

In 2005, Sallie Mae was named by Fortune as the second most profitable company in the US (Microsoft was 18th that year), with its CEO Albert Lord the highest-paid CEO in Washington, D.C., that year. In 2007, the New York Times estimated Lord’s holdings in the company at $450 million. In 2008, he received $4.7 billion in compensation, according to the Washington Post.

While the market crash of 2008 meant decreased earnings for the loan giant, as of 2010’s second quarter, SLM is back with a “respectable” earning rate of $0.39 a share or $209 million including interest income of $759 million, a good investment for Wall Street at the expense of increasingly indebted students.

How does this incestuous relationship between Sallie Mae, guarantors, and the federal government work?

For example, you borrow what is in fact a modest $20,000 to attend a public university, say the University of Michigan for four years, and pay out of pocket an additional $80,000 minimum during that time for room and board. You elect a 12-year loan repayment plan. The federal government will guarantee this. If you pay this off at 8.8 percent interest over 12 years, you will pay $23,376 in finance charges.

If you cannot pay the $293 a month, after 270 days you will default. The federal government will pay Sallie Mae the balance of the loan, plus interest. It will then send the debt to a collections agency. The agency w ill add 25 percent to the loan as a collection fee. Additionally, it will receive a 28 percent commission on the loan (which you will pay). The largest collection agencies in the country are owned by Sallie Mae; therefore, they get the “second bite of the apple.” The agency can garnish your wages, tax refunds, etc. There is no statute of limitations, meaning that even if it waits until you claim Social Security, you will pay. [5]

In 2005, the Bankruptcy Abuse Prevention and Consumer Protection Act (engineered by the credit card companies and banks) made all student loans, even those not guaranteed by the federal government, nondischargeable in bankruptcy. [6] Student loans were also specifically exempted from state usury laws and exempted from coverage under the Truth in Lending Act.

More than 5 million defaulted student loans are on record with the US Department of Education as of 2009; Collinge estimates there are at least another 1 million private loans in default in addition.

Collinge’s volume goes on to detail the illegal relationships between Sallie Mae, Congress, and the Department of Education (which supposedly was in charge of oversight) and the financial aid departments of colleges. Bribery, kickbacks and conflicts of interest are everywhere.

Just to cite one example among many from the book, a 2006-2007 investigation by New York politicians Eliot Spitzer and Andrew Cuomo revealed, among other wrongful acts:

• Lenders were paying kickbacks to universities based on a percentage of loan volume that the schools’ financial aid offices steered to lenders.

• Lenders provided all-expenses-paid trips to financial aid administrators and their families to exotic destinations.

• Lenders ran call centers on behalf of universities, often answering phones claiming to be representatives of financial aid offices when they were really employees of lenders.

• Lenders offered large sums of money to universities to drop out of the government Direct Loan Program.

As a result of this one investigation, the University of Pennsylvania, New York University, Syracuse, Fordham, Long Island University and St. Johns agreed to reimburse former students a total of $3.27 million for inflated loans.

The social costs

• Families are spending higher and higher proportions of their income to assist their children in getting an education. A 2008 study by the National Center for Public Policy and Higher Education, cited in Debt-Free U by Zac Bissonnette, [7] states that low-income families contribute, on average, 55 percent of their earning towards their children’s public, four-year institutions, up from 39 percent in 2000.

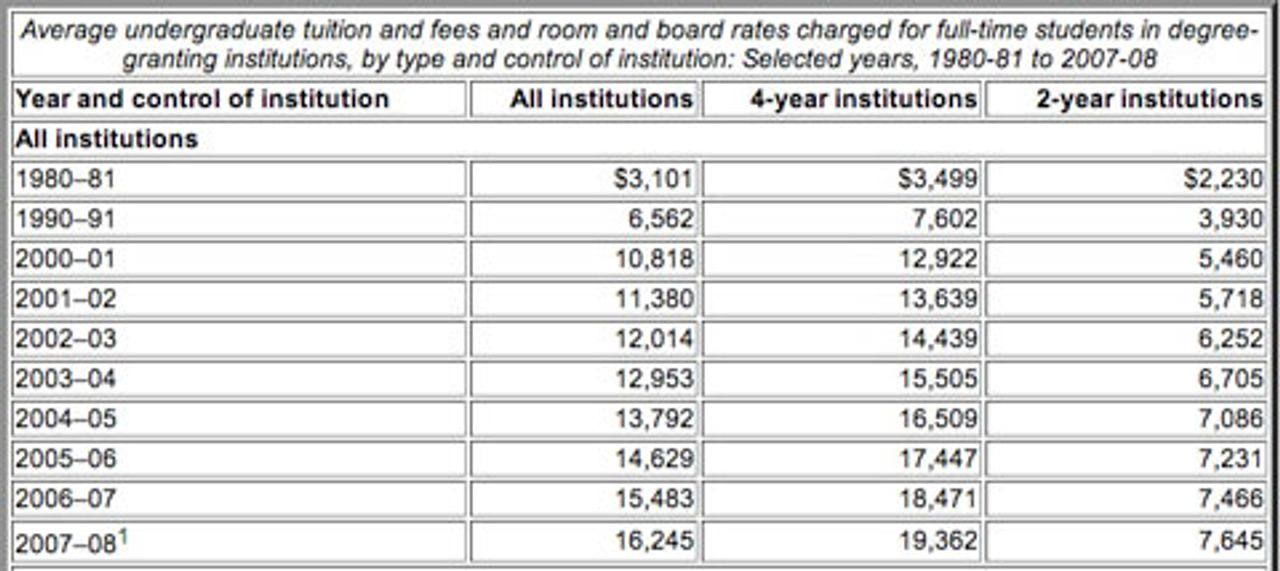

• The average cost, net of grants, for attending a four-year public university for a low-income student is $11,700 annually, with an average loan burden of $36,000. For students from moderate-income families, the cost will be $18,450 annually with a loan burden of $63,800, according to “The Rising Price of Inequality.

• Instead of four-year colleges, many young people are opting for community college, highly touted as a cost-effective solution. “The Rising Price of Inequality” study shows that there is a big hidden cost: high school graduates from low-income families who enroll in a community college, as compared to a four-year university, are four times less likely to earn a bachelor’s degree. Even before the current economic crisis, the rates of enrollment in four-year colleges for academically qualified low-income students had declined precipitously. In 1992, 21 percent of low-income students enrolled in a two-year college; by 2004, that number had risen to 31 percent.

• Even prior to the economic meltdown, a USA Today and National Endowment for Financial Education poll found that 60 percent of twenty-somethings feel they’re facing tougher financial pressures than their parents did at their age, and 30 percent said they worry frequently about debt. Debt-Free U documents studies showing that 50 percent of those who struggle with debt can be classified as depressed and nearly 40 percent as “severely depressed.”

• For students who aspire to graduate school and a professional degree, the levels of debt are staggering. The public service site FinAid.org shows estimates of cumulative debt based on graduate school type. [8]

A few real stories

Ellen from Pennsylvania is profiled in The Student Loan Scam. She had only a GED (General Equivalency Diploma), but after her husband died in an auto accident, she applied to college. She was admitted and was able to finance it by working, grants and federally guaranteed loans. She excelled and went on to graduate school, maintaining a high grade point average. But her father had a heart attack and then a stroke. She was needed to care for her elderly mother.

When her parents’ situation worsened, Ellen had to drop out of school and work part-time. Her loan has risen, due to penalties, from $14,500 to more than $31,000. She says she has lost numerous jobs over the company’s attempts to garnish her wages. She has sold almost everything she owns and survives largely on her 85-year-old mother’s pension and Social Security. She filed for bankruptcy, but that did not discharge her student loan. She said, “My life is ruined. If only I would have worked my way through college slowly and paid for it as I went—or not gone at all. Maybe the factory work wasn’t so bad after all—at least there I had my dignity.”

“I had borrowed around $60,000 in federally backed Stafford Loans to go to Law School in the mid 90s,” says a reader of collegescholarships.org. “After graduation, I consolidated the loan (it cost maybe $7,000 to do so) and then the loan was sold and re-sold a few times, and finally ended up with Sallie Mae anyway, where it more than tripled over a period of 10-12 years.

“I never could make the payments. They were $700 a month after graduation in 1996, and are now close to $2,000. I just never had the extra money after my rent and car payment, etc. I never was very successful in law. I just kept signing up for more forbearances, and economic hardship deferments, etc. But the interest never stopped accruing (I never had the option of preventing that). I never understood how it all worked—nobody did really.

“It is only in the last couple of years that people like Allan Collinge and C. Cryn Johanassen have tried to analyze the whole crazy Student Loan ‘Phantom Industry’.

“…I ended up using up all of my forbearance and hardship options, and defaulted with Sallie Mae about two years ago. The loan went back to NY State Higher Ed. All was quiet for several months, until I started getting calls from a private collection agency, offering me yet another consolidation ‘opportunity’. This time with Direct Loans.… The collection agency instantly added $10,000 to the balance as a result, and the loan is now in the hands of Direct Loans or the federal government, as I say.

“And there the loan will stay for the next 20 to 25 years, collecting interest of course. If I never pay off the balance, the loan will be ‘abated’ or discharged. But I will owe taxes on the discharged amount.

“Fair enough. If the balance on the loan is half a million dollars, I will owe the IRS over $150,000 in taxes I think. If I cannot pay that, I go to jail because isn’t that what the IRS does to delinquent taxpayers? Put them in jail? And that is how many other Educated student loan borrowers will end up in jail when they should be getting ready for retirement.

“The good news is that I now can now make income-based payments, which provides for a chance to try and better my income, and figure out a way of possibly paying the loan off, because I certainly do not want to end up as a new fish in what amounts to a debtors’ prison someday. And I must say that is a big motivation.

“I was married at one time, and my ex would wake up at 3 a.m. many times, very worried about the student loans, and the idea of her tax return being garnished—a lien on the house that was in her name—and other possible collection efforts. Lots of paranoia. But the cause of real worry and stress nonetheless.

“We ended up divorcing. The student loans played a part in breaking up the marriage. They were entirely mine, taken out before the marriage. But somehow, it seems, a spouse can now be dragged into the whole financial mess, no matter when the loans were taken out. So maybe the divorce was a blessing for her. It allowed my ex-wife to retain all of her assets, and the roof over her head.

“I’m willing to take all of the blame. At age 45 I am an unsuccessful man so far. There is no greater proof of that than my student loans, which are close to $300,000 and growing. In conclusion, I believe that all bad Student Loan Debt will end up like mine—in the hands of Direct Loans or the federal government—discharged after 20 to 25 years with a possibly hefty tax bill to pay, and in the hands of the all powerful IRS.”

An August 7, 2010, article in the Wall Street Journal, “When Student Loans Live on After Death,” detailed the case of a private student loan company that punitively pursued the co-signing parents of a young man who tragically died of a fall while attending Rutgers University. The parents have continued to pay on the loan. The article points out: “Mae, Citibank and Wells Fargo may require co-signers to continue paying private student loans after the primary borrower has died, though the lenders say they will look at cases individually. Wells Fargo doesn’t offer medical forbearance, just a three-month period of hardship forbearance during which the interest compounds.

“Sallie Mae—formerly a government-sponsored enterprise but fully private since 2004—recently introduced forgiveness in cases of death for its Smart Option Student Loan, but doesn’t require it in its other private student loans. A Citi spokesman says, ‘We believe our policies are generally consistent with other industry participants.’ ”

The Socialist Equality Party

The Socialist Equality Party puts the blame for this social crime on the financial institutions that have shamelessly taken advantage of the population’s desire for education to extract obscene profits. Our program states, “discussion of equality in a society where access to education is largely determined by income is a fraud…. Higher education, including continuing education for adult workers, is a necessity in modern society and must be guaranteed to all free of charge.”

We reject the near-constant refrain, shared by Debt-Free U, that students are responsible for their indebtedness and that they should downgrade their expectations. Columnists such as the New York Times’s David Brooks have suggested that the US has too many educated youth and this unreasonable surfeit of education is now skewing the unemployment figures. This layer is advocating for a return to the conditions when only the elite had the right to be educated.

Nor can this huge social issue be in any way addressed by pressuring Congress and the Democratic Party, as advocated by Alan Michael Collinge.

The Democratic Party, wholly subservient to the financial oligarchy, is not considering a single measure to challenge the ability of the banks to profit handsomely on the cost of higher education.

The Health Care and Education Reconciliation Act, signed by Obama on March 30, 2010, represents a net decrease in government funding for education. By eliminating the subsidies for private loan origination, the government will save an estimated $68 billion. From this pot, Pell Grants for the most impoverished students will rise by a miniscule $200 a year each, far less than average tuition hikes.

In what passes as a “reform,” students have been offered the chance to extend their loans longer, based on an annual ceiling of 10 percent of income. Interest rates will decrease (this year) but, due to the extraordinary low Federal Reserve rate, remain highly profitable for the banks. After 25 years of payments, remaining federal student loan debt can now be discharged. Students will remain in indentured servitude until their own children enter college.

Even the most aggressive of the tepid measures discussed on Capitol Hill merely calls for allowing students to declare bankruptcy, restricting the so-called subprime loans to overborrowed students or penalizing private colleges that pay recruiters and have huge student default rates.

The Socialist Equality Party considers education a basic right. It should not be a source of profit. We call for the forgiveness of all student loan debt and the right to free education for all, from pre-school through college and adult education. There must be a series of socialist policies to dramatically expand education and provide access to mankind’s collective culture to all on a free and equal basis. We urge students to join the International Students for Social Equality, study the program of the Socialist Equality Party and devote themselves to fighting for these policies throughout the working class.

Notes:

5. Adapted from CollegeScholarhips.org

6. The Nondischarability of Student Loans in Personal Bankruptcy

7. Bissonnette, Zac. Debt-Free U, Portfolio Penguin, New York, NY: 2010.

8. See: http://www.finaid.org/loans/

Receive news and information on the fight against layoffs and budget cuts, and for the right to free, high-quality public education for all.