A study released Tuesday by the Congressional Budget Office (CBO) reports that the richest 1 percent of US households nearly tripled their income between 1979 and 2007 and doubled their share of the national income.

The report also concludes that the top 20 percent of US households increased its share of national income while every other quintile saw its share decline. The top 20 percent received 53 percent of income in 2007—that is, its income surpassed the income of the other 80 percent of Americans.

Source: Congressional Budget Office

Source: Congressional Budget OfficeThis documentation of the staggering growth of inequality in the US by the nonpartisan budget analysis arm of Congress highlights the conditions underlying the anti-Wall Street protests that have spread across the US and internationally. The protests have focused on social inequality and the domination of the corporations and banks over the political system and every aspect of life. The burden of this domination has become unbearable for millions of youth and workers under conditions of mass unemployment and brutal cuts in education, health care and other social necessities.

The CBO analysis, based on Internal Revenue and US Census data, closely tracks previous studies on income inequality in the US by private organizations and academic economists, but represents an official government acknowledgment of the sharp increase in inequality.

Source: Congressional Budget Office

Source: Congressional Budget OfficeThe major findings of the report include:

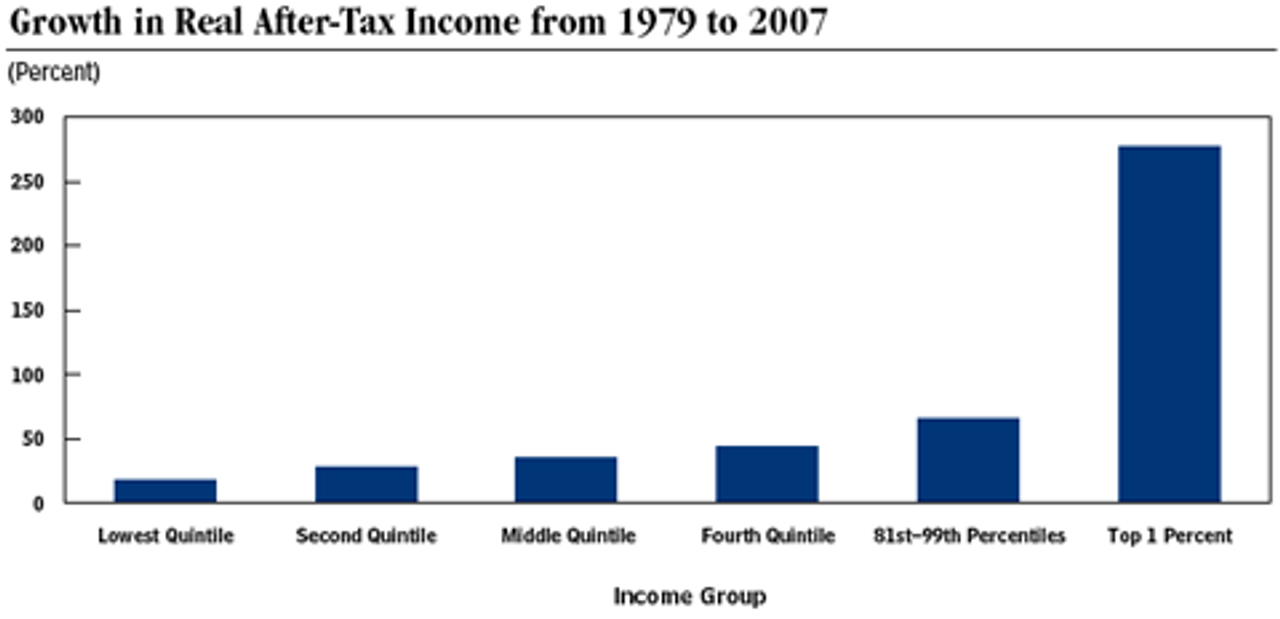

• Average inflation-adjusted after-tax income for the 1 percent of the population with the highest income grew by 275 percent from 1979 to 2007. Their share of national income rose from nearly 8 percent in 1979 to 17 percent in 2007.

• For the rest of the top income quintile, average real after-tax income rose by 65 percent.

• For the three-fifths of people in the middle of the income scale, the growth of after-tax real income was under 40 percent. Their share of national income declined by 2 to 3 percentage points.

• For the poorest fifth of the population, average real after-tax household income rose by only 18 percent between 1979 and 2007. Their share of national income was about 5 percent, down from 7 percent in 1979.

The CBO report attributes the increased concentration of wealth at the top primarily to changes in the private economy, including the growth of the financial sector, the increased share of wealth for the rich from capital gains, and sharply higher CEO and executive pay. However, it acknowledges that federal tax policy over the nearly thirty-year period has favored the wealthy over ordinary working people. “The equalizing effect of federal taxes was smaller” in 2007 than in 1979, as “the composition of federal revenues shifted away from progressive income taxes to less-progressive payroll taxes,” the report states.

The CBO also cites the cutting back on cash payments to lower-income Americans, such as Social Security benefits, Medicare and unemployment insurance.

The study defines household income to include so-called “transfer” payments—income from Social Security, unemployment insurance, workers’ compensation, other federal programs, state and local assistance programs, food stamps, school meals, housing and energy assistance, Medicare and Medicaid. Were these sources not included and income defined more narrowly as wages and benefits, the disparities in income would be considerably larger.

Moreover, the study ends prior to the onset of the financial crisis and recession. The past four years have seen a further widening of the social chasm as the Obama administration, on behalf of the corporate-financial elite, has carried out a right-wing program to place the burden for the crisis on the working class and intensify the assault on wages, benefits and social services.

The massive growth of social inequality over the past three decades has been the result of an unrelenting ruling class offensive against the working class. That assault has been carried out under Democratic as well as Republican administrations.

The offensive was launched in earnest with Reagan’s firing of the PATCO air traffic controllers in 1981. That was the signal for more than a decade of wage-cutting, strike-breaking, union-busting and labor frame-ups, made possible by the complicity of the trade union bureaucracy. It deliberately isolated and betrayed scores of bitter struggles in order to break the militant resistance of the working class.

The unions simultaneously adopted a corporatist policy of labor-management “partnership” to integrate themselves into the structure of corporate management and bind them even more firmly to the capitalist state. The strike weapon was abandoned and the unions transformed into business entities whose essential function is to suppress the class struggle.

This went hand-in-hand with the deindustrialization of the US and a huge growth of financial speculation, tax cuts for business and the wealthy, the deregulation of the corporations and banks, and increasingly onerous cuts in social programs.

All of these processes have been accelerated since the Wall Street crash of 2008 and ensuing bailout of the banks. The opposition of the Obama administration and the entire political establishment to any serious measures to address mass unemployment has produced a further impoverishment of broad social layers.

The spread of social misery in the midst of soaring corporate profits and CEO pay is starkly shown in the growth of poverty in US suburbs. The New York Times on Tuesday reported that the ranks of the poor living in the suburbs of US cities rose by more than half between 2000 and 2010. Two thirds of these new suburban poor dropped below the official poverty line between 2007 and 2010.

The Times article, reporting analyses of US Census data by the Brookings Institution, said the increase in poverty in the suburbs was 53 percent, compared with 26 percent in the cities.

Nationwide, 55 percent of poor people in metropolitan areas now live in the suburbs, up from 49 percent in 2000. The newspaper quoted Elizabeth Kneebone, a senior researcher at the Brookings Institution, as saying, “For the first time, more than half of the metropolitan poor live in suburban areas.”

The Detroit metro area had the highest proportion of poor people living in its suburbs at 59 percent in 2010. Cleveland was second with 57 percent.

Meanwhile, the plundering of the economy by the financial aristocracy continues. USA Today reported Wednesday that directors who sit on the corporate boards of Fortune 500 companies will see their pay increase this year by 10 percent from 2010, rising to a median figure of nearly $234,000. The CEOs and retired executives who fill these boards average about 4.3 hours a week on board work, according to a recent study by the National Association of Corporate Directors.

The CBO report on income inequality underscores the total disconnect between the Obama administration and the entire political system on the one hand and the interests and desires of the vast majority of Americans on the other. The political and media establishment is presently consumed with a debate over how much further taxes for the corporations and the rich should be cut and how much more deeply social programs for workers and poor people should be slashed.

The various right-wing policies being advanced on all sides will dramatically increase the chasm separating the top 1 percent from the broad masses of people. On the tax front, Obama and the Democrats are pushing for a bipartisan tax “reform” that would substantially reduce corporate taxes and tax rates for the wealthy.

The Republicans are calling for even more drastic cuts in taxes for the rich, with the contenders for the 2012 Republican presidential nomination advancing rival plans to eliminate entirely income taxes indexed to wealth and replace them with a “flat” tax that would cap rates at between 9 percent (Herman Cain) and 20 percent (Rick Perry). These plans are designed not only to provide a windfall for the rich, but also to undermine federal entitlement programs such as Medicare, Medicaid and Social Security.

Both parties are simultaneously proposing rival plans to slash social spending. On Tuesday, Senate Democrats called on the congressional “supercommittee” established to come up with a bipartisan proposal to reduce the federal deficit to adopt the Obama administration’s plan for $3 trillion in deficit reduction over the next decade, including $500 billion in Medicare and Medicaid cuts.