An aerial view of drought affected Colorado farm lands, 74 miles east of Denver, Colorado on Saturday, July 21, 2012 [Photo: USDA]

An aerial view of drought affected Colorado farm lands, 74 miles east of Denver, Colorado on Saturday, July 21, 2012 [Photo: USDA]Severe drought spread rapidly across the central US this week, further damaging staple crops and heightening the risk of a global food crisis. The Midwest, where roughly one-third of the world’s staple grains are produced, is experiencing the deepest dry spell in over half a century.

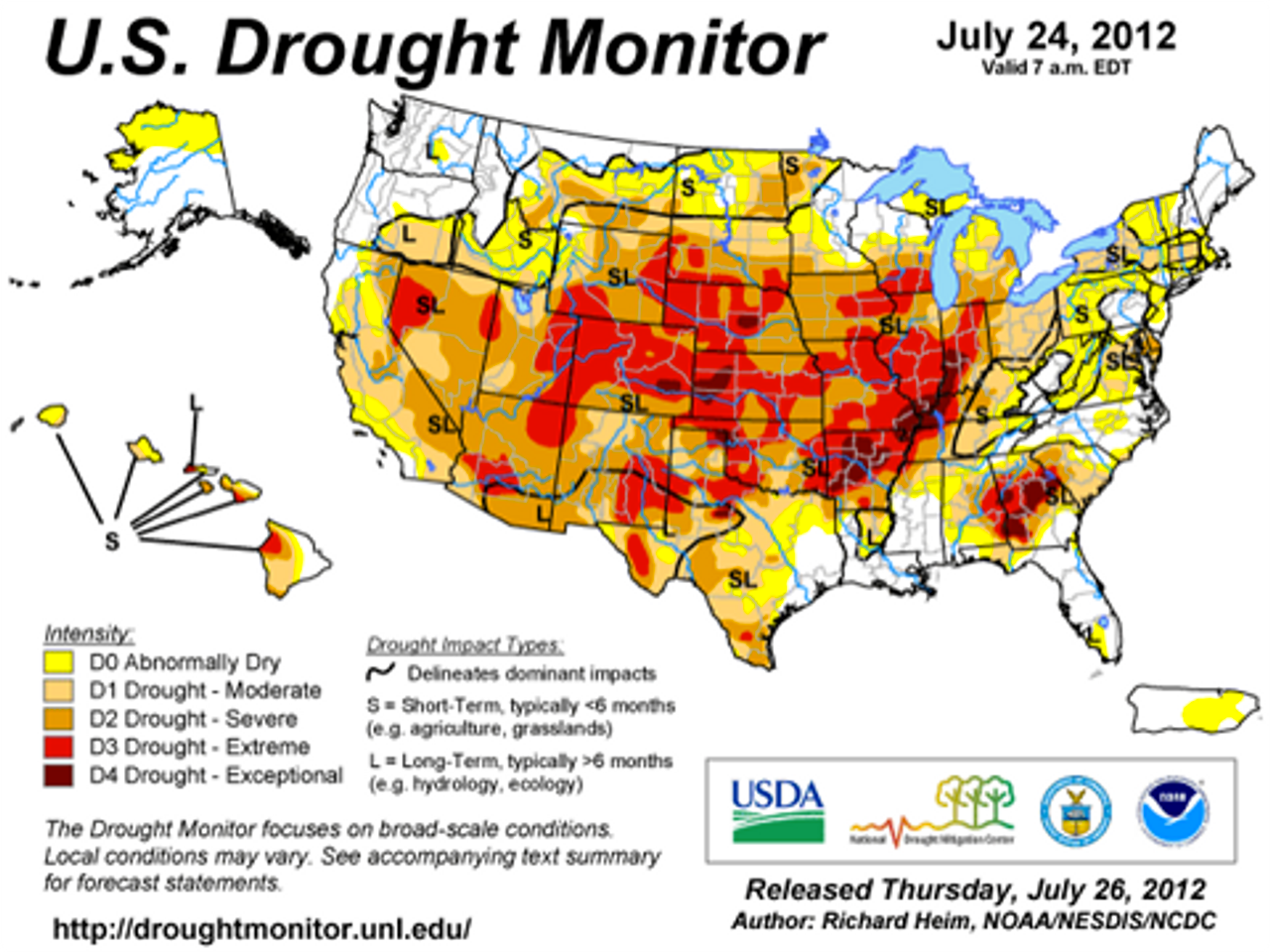

The National Drought Mitigation Center in a statement Thursday reported “tremendous intensification of drought through Illinois, Iowa, Missouri, Indiana, Arkansas, Kansas and Nebraska, and into part of Wyoming and South Dakota in the last week.” Almost 30 percent of the Midwest is under extreme drought, triple that of the previous week.

Every state in the country had some counties under abnormally dry or drought conditions, making the disaster the most widespread US drought since the Dust Bowl of the 1930s. The US Department of Agriculture (USDA) has declared 1,369 counties across 31 states disaster areas—officially the largest US disaster on record.

Every state in the country had some counties under abnormally dry or drought conditions, making the disaster the most widespread US drought since the Dust Bowl of the 1930s. The US Department of Agriculture (USDA) has declared 1,369 counties across 31 states disaster areas—officially the largest US disaster on record.

“It’s getting to the point where some of the damage is not reversible,” said Brian Fuchs, a climatologist at the center. “The damage is done, and even with rain, you’re not going to reverse some of these problems, at least not this growing season.”

With temperatures remaining in the triple digits across the Midwest, scattered rainstorms did little to restore moisture to topsoil. Iowa State University agronomist Roger Elmore said that over the week, “most of the state got a quarter- to half-inch of rain. We lose the equivalent of a quarter-inch of moisture every warm, sunny day.”

Meteorologists with the National Oceanic and Atmospheric Administration’s Climate Prediction Center have warned that the high heat and dry spell could extend through October. Through June, the year has been the hottest ever recorded for the US. Globally, land temperatures likewise broke all previous records last month. The extreme weather corresponds to projections issued by climatologists over the past three decades, indicating the worsening impact of global warming.

“This year is very emblematic of the type of thing we worry about with climate change,” David Lobell of global warming monitor Climate Central told ABC News. “The new normal for agriculture is going to be frequent episodes of very high temperatures. Temperatures at which pretty much any crop does not do very well.”

For the seventh consecutive week, the USDA on Monday downgraded its assessment of corn and soybean crops. For the week ending July 22, the portion of the corn crop rated in “poor” and “very poor” condition rose to 45 percent. Thirty-five percent of soybean acreage was rated poor to very poor. Purdue University agricultural economist Chris Hurt told the World Socialist Web Site in a recent interview that a rating of “very poor” likely meant such crops were “approaching no yield.”

Since June 3, the portion of corn rated in “good” to “excellent” condition plummeted from 72 to 26 percent. Seven of the largest corn-exporting states now have only one percent or less of corn acreage assessed as “excellent.” A similar plunge was recorded in soybean acreage (65 to 31 percent).

The assessment is the worst since the drought of 1988, when small farmers went out of business en masse after a decade-long rural economic crisis.

The impact of the agricultural disaster on the global food supply is compounded by a speculative frenzy on grain futures on the Chicago Board of Trade. Last week corn futures surpassed all-time records at $8.2875 a bushel, before falling back on news of rain. As of Friday, corn for September delivery was trading at $7.9375 a bushel. Some analysts have suggested that corn futures for December delivery could fetch $9 or more per bushel in August if climate predictions prove correct.

The impact of the agricultural disaster on the global food supply is compounded by a speculative frenzy on grain futures on the Chicago Board of Trade. Last week corn futures surpassed all-time records at $8.2875 a bushel, before falling back on news of rain. As of Friday, corn for September delivery was trading at $7.9375 a bushel. Some analysts have suggested that corn futures for December delivery could fetch $9 or more per bushel in August if climate predictions prove correct.

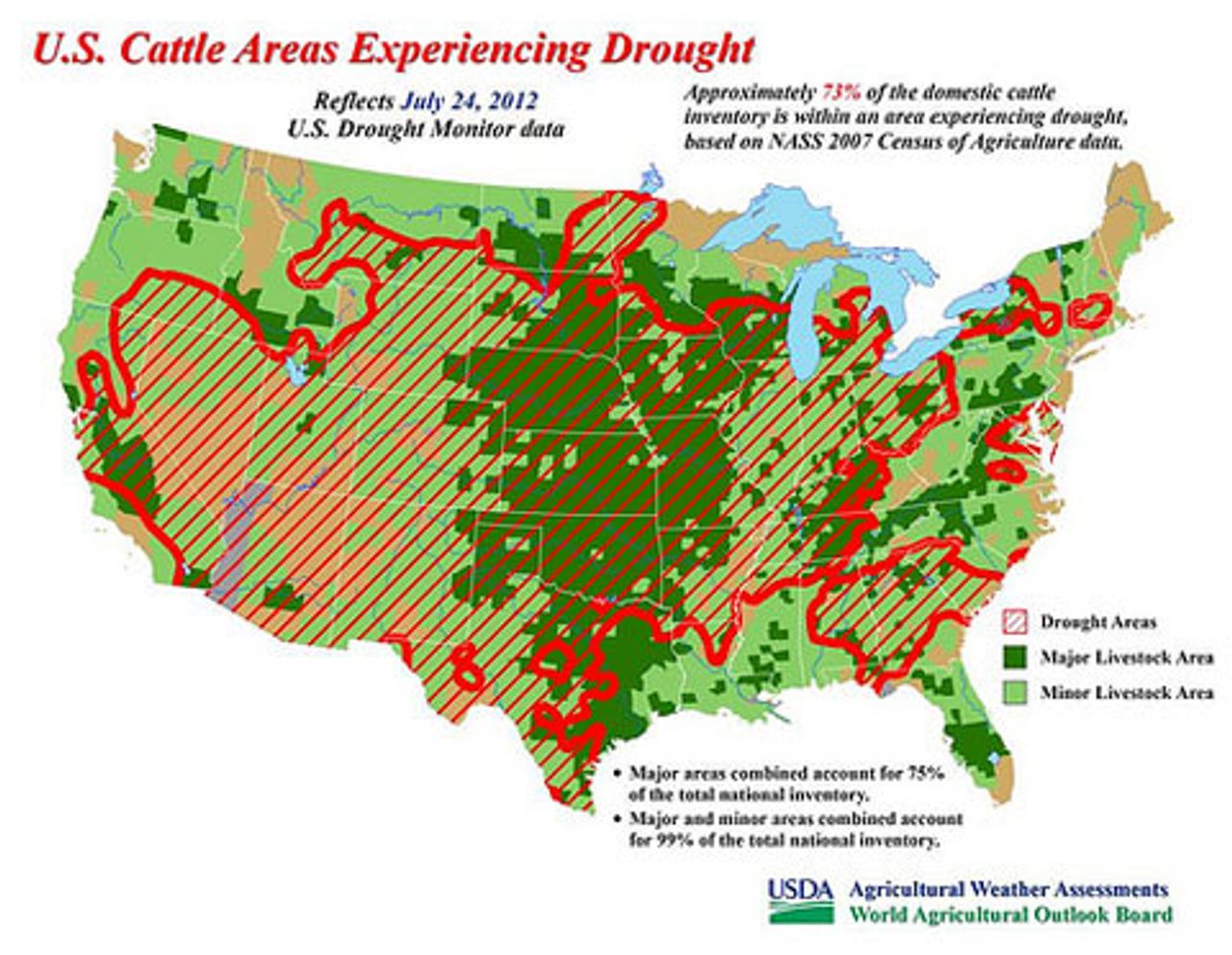

With pastures in ruin and feed prices driven up in trading, smaller US livestock producers are facing the prospect of liquidating their herds. As a result, supermarket prices for beef, pork, and other meats are likely to surge in the coming year, after the initial influx of slaughtered herds. Prices for quick-to-market meats such as chicken and eggs, as well as dairy products, will likely rise more swiftly.

The USDA on Wednesday announced that supermarket prices would rise in coming months. Currently it projects beef prices will rise 4 to 5 percent, and dairy products 3.5 to 4.5 percent.

However, large meat producers are warning that cheaper meats such as pork and chicken will become “luxuries” if Washington does not suspend a program enabling the energy industry to secure up to 40 percent of the US corn crop for ethanol production.

“I’ll use the word catastrophe—that’s my definition,” Larry Pope, head of Smithfield Foods, the world’s largest pork producer, told the Financial Times. In June, Smithfield moved to lock in feed costs on the futures markets before corn broke $8 a bushel. “I thought that $6 corn was the end of the world,” he said. “I never could have realized that I would be thankful to be buying it at $7.”

“Beef is simply going to be too expensive to eat,” Pope said. “Pork is not going to be too far behind. Chicken is catching up fast… Are we going to really take protein away from Americans?” He said US meat prices would rise by “significant double digits” per year.

Even a less drastic price increase in protein food sources would compell millions of low-income Americans to choose what they can afford to buy over the nutritional value provided.

The disaster bears brutal consequences for the populations of import-dependent countries across Asia, the Middle East, Africa, and the Caribbean. In 2008, riots erupted in more than 30 countries after a similar confluence of severe weather and speculation drove up staple food prices. Among the billions of people living on $2 a day or less, the cost of food consumes as much as three-quarters of a family’s income.

Grain suppliers are beginning to default on deals with importers in Egypt, Libya, and Iraq. Egypt, the world’s largest consumer of wheat, is turning to Russia as the US drought deepens. However, Russia has also cut its wheat outlook by 3 million tons.

The US corn outlook negatively impacts wheat exports, as a poor corn harvest tends to mean wheat is held more tightly for domestic use. Because Egypt imports half of its wheat, and a quarter of its wheat imports originate in the US, any fluctuation in the grain’s price or supply sharply impacts living conditions in the country. Forty percent of the Egyptian population subsists on $2 a day or less.

The world’s population is subjected to the irrationality of the market, and the disjointed global food system. Barges loaded with Southeast Asia-bound grain have clogged Indian ports, creating delays of up to 25 days. Spotty rains in Asian growing regions may further compound food shortfalls and inflation.

“The deficit in rainfall will definitely cause food inflation to go up,” Dun & Bradstreet economist Arun Singh told Reuters. “The extent of the impact will be known only after the monsoon is over.” With monsoon season half over, some agricultural areas of the country have seen rainfall 68 percent lower than average. Food inflation in India is already 10.81 percent, significantly higher than general inflation; on lentils, chickpeas, potatoes, and other staples, the rise is far higher.