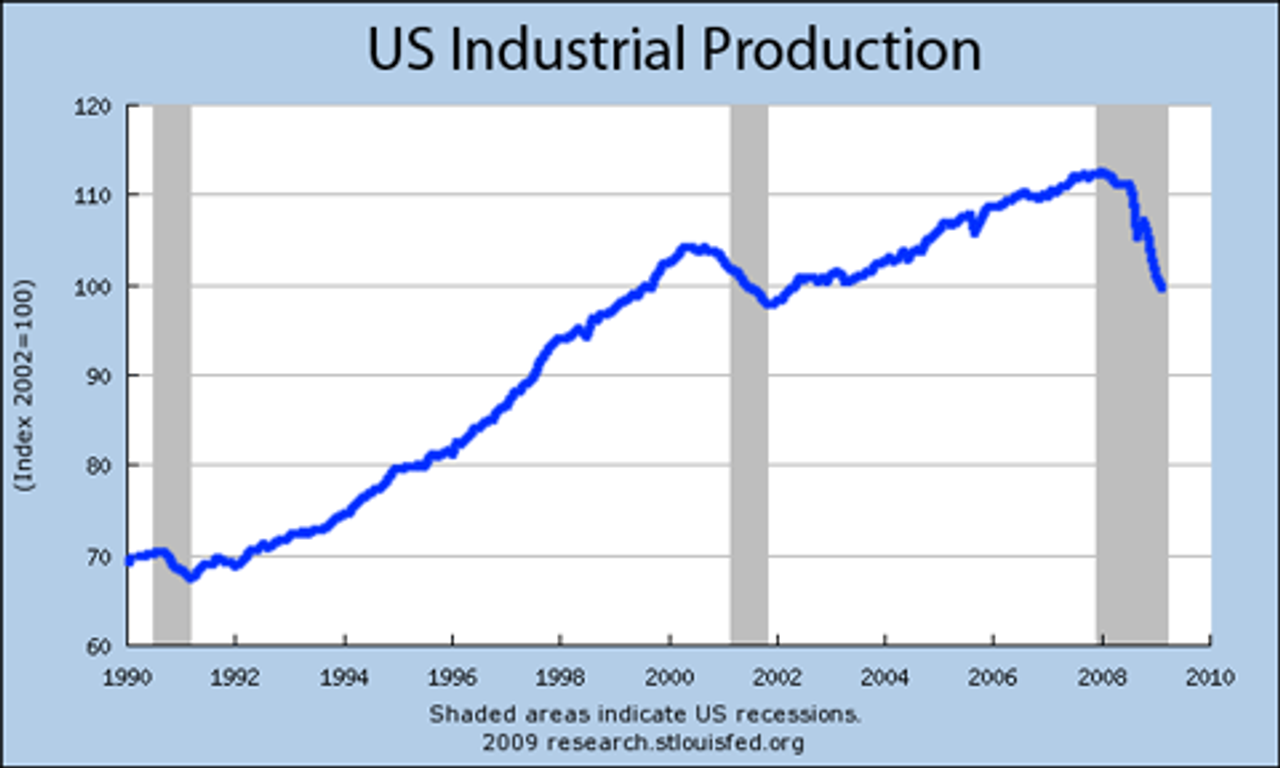

Industrial production in the US fell by 1.4 percent in February, marking the fourth consecutive month that the figure has fallen. Output has contracted in ten out of the last twelve months, according to figures released Monday by the Federal Reserve.

Business investment and the utilization of manufacturing plants both fell last month, reaching lows last seen in 1982, according to data from the same report. US industrial production has fallen by 11 percent over the past year.

Last month's contraction in industrial output translates into an annualized rate of 17 percent.

The grim figures pointed to a sharp and continued deterioration of the US economy. "There is no relief in sight," Ian Shepherdson, chief US economist at financial market analyst firm High Frequency Economics, wrote in a research note.

A series of layoffs, a surge in home foreclosures, and new statistics on the record contraction of wealth indicated that the US recession is worsening significantly.

National Semiconductor, the computer parts manufacturer, announced last week that it would eliminate 1,725 jobs, or a quarter of its workforce. Global sales of computer chips are expected to fall by 24 percent from last year's level as world trade contracts and demand retrenches worldwide.

Caterpillar Inc, the maker of construction equipment, announced that it would lay off another 2,454 workers. This comes on top of the 22,000 layoffs the company announced in February. Baker Hughes, the energy company, announced another 1,500 layoffs.

But even these figures hardly compare to the bloodbath in the auto industry. More than 235,000 workers in auto and parts production have lost their jobs in the last year, amounting to a quarter of the total workforce.

The number of cars registered in the US decreased for the first time since the Second World War, according to estimates published last week by R.L. Polk, the auto industry research firm. The number of cars owned by Americans is slated to fall by four million, or 1.6 percent, as the downturn intensifies.

The slackening demand for cars has cascaded down through the auto parts suppliers. An auto industry consultant last week said that more than 500 US auto parts suppliers are near bankruptcy.

Foreclosure activity increased by 30 percent in February over the previous month, according to a report published by RealtyTrac, the property marketplace, last week.

"The increase in foreclosure activity from January to February is somewhat surprising, given that many of the foreclosure prevention efforts and moratoria in place in January were extended through most of February as well," said James Saccacio, RealtyTrac's chief executive. The increase in foreclosures came despite token initatives taken by states and the federal government to stem foreclosures.

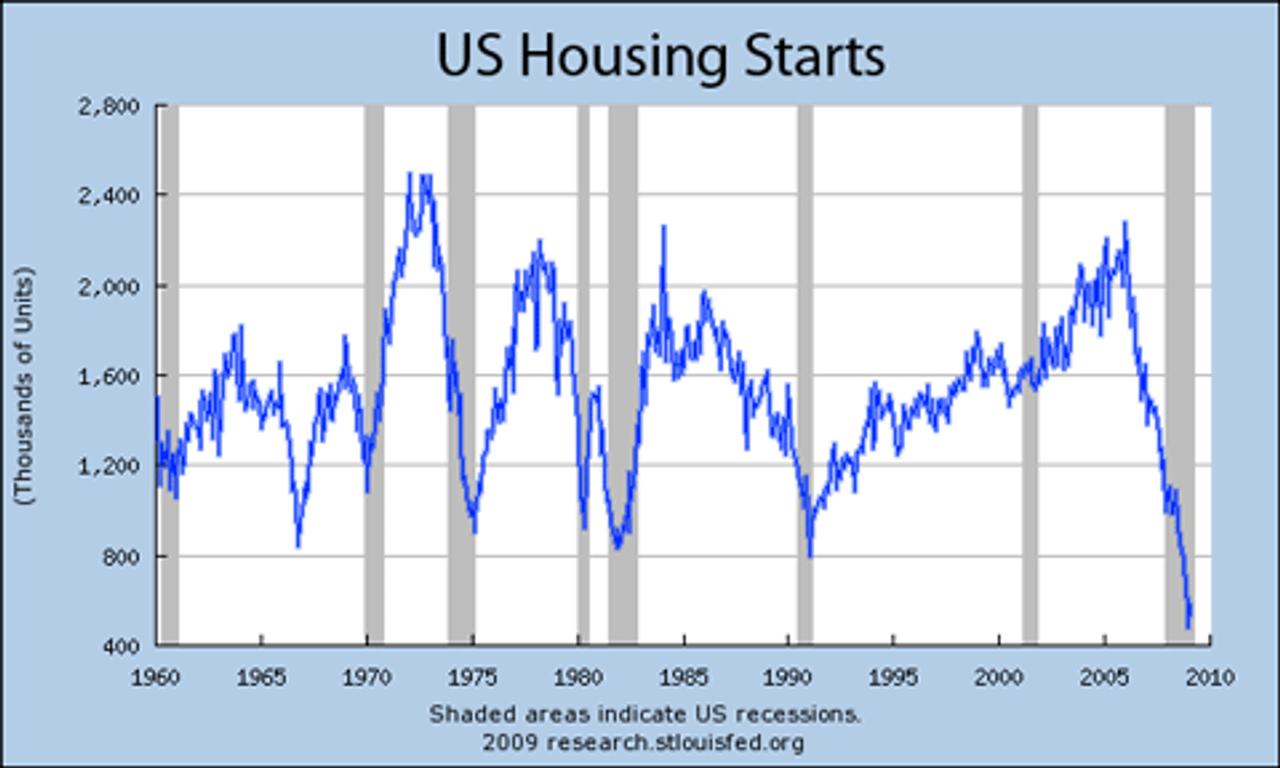

The figures confirm previous grim assessments of the housing situation. One in nine homeowners is either in default or foreclosure, according to a report issued this month by the Mortgage Bankers Association. The report found that nearly 12 percent of home mortgages were late by at least one payment in the fourth quarter of last year. The figure was about 10 percent in the third quarter.

The number of new homes under construction, however, jumped 20 percent in January, leading some commentators to optimistic conclusions. "Many are interpreting the February data on starts and permits as signs that a bottom is forming in the housing market," Richard F. Moody, chief economist at Forward Capital, wrote in a note to investors. "This is more a case of wishful thinking than a reflection of reality." Indeed. Housing starts have fallen by over 80 percent since their peak in 2007, and by 44 percent in the past year alone. Last month's increase can hardly be seen in the graph below.

Inventories have continued to shrink in January, but retail sales fell even faster as consumers reined in their spending. Sales fell 2.9 percent in January, after a fall of 3.7 percent the month before.

Claims for unemployment insurance continue to increase. The Labor Department said last Thursday that the number of people requesting unemployment payments hit 654,000, up from 645,000 the previous week.

A number of prominent observers have divined signs of recovery from recent events. The major stock indices have in fact recovered partially over the last week, led by financial stocks, which were bolstered by some banks' announcements that they might return to profitability in the first quarter.

Federal Reserve chairman Ben Bernanke appeared on CBS for an hour-long interview in which he claimed to see "green shoots of recovery" poking through the economic snow. But it seems he's looking a bit too hard. Despite the week-long stock market rally, all the fundamentals of economic growth—trade, production, employment—are deteriorating at an increasingly rapid pace.