The Australian Labor government’s imposition of a “Resource Super Profits Tax” has been met with an extraordinary response from the mining sector. The Minerals Council bought full-page advertising space in national newspapers to denounce the tax as “a real threat to Australia’s prosperity”. One mining magnate condemned Prime Minister Kevin Rudd’s government as “communist”, while Business Spectator’s Robert Gottliebsen declared that Australia is on the brink of “the greatest capital strike in the country’s history and one of the largest ever seen in the world”.

The furore provides a revealing glimpse into the social and political physiognomy of the ultra-wealthy oligarchic layer that has developed in Australia in the past decade through the China-fuelled boom in minerals and commodities prices.

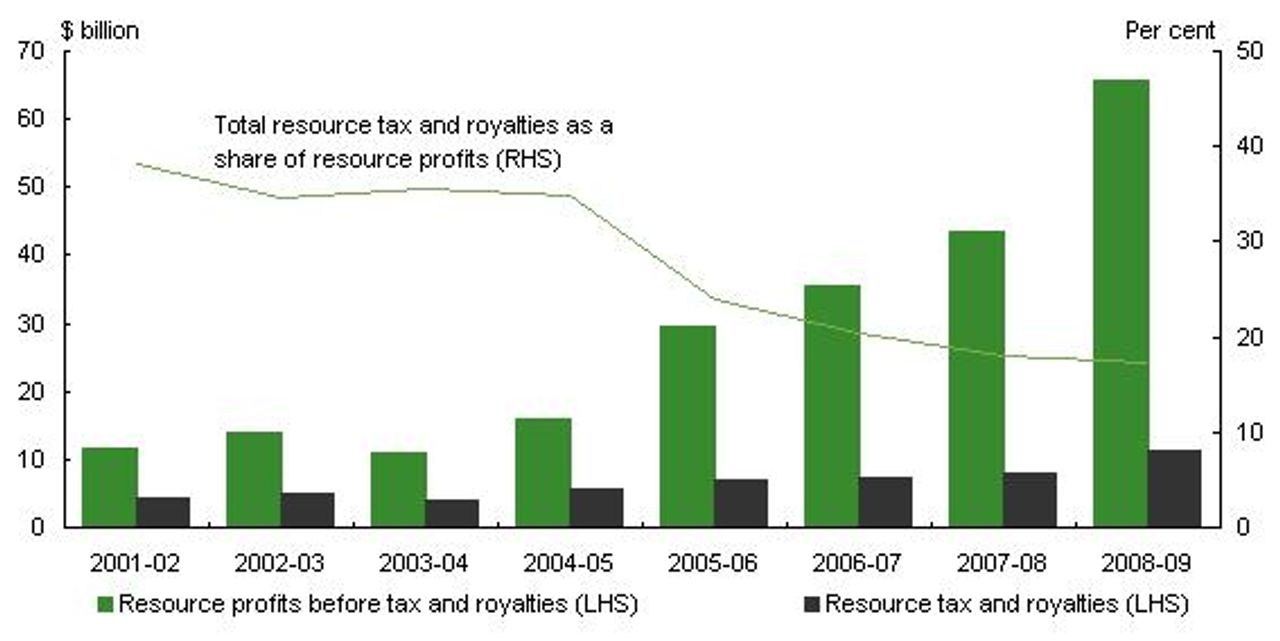

Leading executives and investors have amassed billions of dollars in personal fortunes as state and federal governments, both Labor and Liberal, have effectively functioned as their paid representatives. The mining CEOs regard as sacrosanct their “right” to plunder the earth’s natural resources for profit. Enormous sums of public money have gone toward providing the sector with high quality infrastructure and a trained workforce, while nothing has been allowed to stand in the way of the sector’s activities, including environmental concerns and workers’ protests over pay and conditions. While mining profits have skyrocketed in recent years, the level of taxes paid has remained largely static.

Decline in taxes paid by mining companies relative to profits (From “Australia’s Future Tax System Review—Report to the Treasurer”)

Decline in taxes paid by mining companies relative to profits (From “Australia’s Future Tax System Review—Report to the Treasurer”)The Rudd government announced the new tax mechanisms last week in “populist” fashion in a bid to boost flagging support. Rudd and Treasurer Wayne Swan declared that the Australian people owned the country’s natural resources and deserved their “fair share” of the profits, that too much revenue was being siphoned overseas by foreign companies, etc. All of this was window-dressing, however, for measures that are quite narrow in scope.

Labor’s proposal amounts to a marginally higher impost. For all the press headlines over an additional 40 percent tax, the real figure will be far lower. Mining companies will benefit from the government’s reduction in corporate tax from 30 to 28 percent. The Rudd government will also nullify existing state royalty payments through rebates. Under the new arrangement, mining company income devoted to productive investment will be protected from resource taxes. The mining giants will also receive a 30 percent tax rebate for exploration costs. Moreover, the sector is to receive one-third of the new revenue collected from the new tax via a Resources State Infrastructure Fund.

Despite its limited character, mining executives immediately mounted a campaign to have the measure withdrawn. Mining billionaire Clive Palmer, an opposition Liberal Party supporter and major donor, declared that the tax was “reminiscent of tax regimes tried by communists and socialists” and threatened to shift operations to low-tax countries such as Papua New Guinea. Fortescue Metals CEO Andrew Forrest, Australia’s wealthiest individual and a close supporter and friend of Prime Minister Rudd, insisted that the new tax would jeopardise his company’s multi-billion dollar investment plans. Forrest called the government’s attempt to tax the industry’s profits and subsidise exploration costs a de-facto “nationalisation of the mining industry” like that introduced by “despotic economies”.

The Liberal-National coalition weighed in on behalf of the mining companies, with deputy opposition leader Julie Bishop declaring that Rudd “appears to be taking a leaf out of the manifesto of Venezuela’s socialist leader President Hugo Chavez”.

Financial journalist Gottliebsen, referring to his discussions with industry chiefs, wrote last Thursday: “In the vicinity $100 billion of resource projects that were almost certain to go ahead are now headed for mothballing until the resources tax is either abandoned or severely modified. If the private words to me and other journalists are converted to action and a new mining project capital strike is launched, then almost certainly Kevin Rudd will not win the next election. The economies of Queensland, WA [Western Australia] and South Australia would be decimated.”

Similar articles have been published in the Australian newspaper in recent days, though again without details of the specific investments supposedly being shelved. It remains to be seen whether the threat of a “capital strike” ever eventuates. No doubt the leaked reports and unsourced reports of private conversations are aimed at putting pressure on Rudd to water down the new tax measure.

The government immediately sought to reassure the mining industry. On May 4, the day after publicly campaigning for his government’s tax reforms, the prime minister flew to Western Australia to meet with executives from some of the world’s leading mining companies, including BHP Billiton, Rio Tinto and Fortescue Metals. The personal visit was a demonstration in abject subservience. While little detail emerged from the closed-door discussion, the government has given every indication that various loopholes, concessions and favourable mechanisms will be included in the final legislation for the Resource Super Profits Tax.

Underscoring the bogus character of their initial “populist” rhetoric, Rudd and Swan have stressed the benefits for the mining companies under the new arrangements.

In a May 6 speech to the Melbourne Press Club, the prime minister declared: “Let me be clear that the design of the RSPT [Resource Super Profits Tax] aims to broaden our mining sector and increase overall mining production. Put simply, if companies aren’t earning super profits, they don’t pay the tax. In fact, the new regime can actually help more marginal mining ventures because state royalties will be refunded, meaning that emerging mining companies may actually get a cash flow gain, and for exploration companies, the Commonwealth has provided a billion-dollar exploration rebate to encourage the development of our natural resources. For these reasons, independent modelling by ECONTECH shows that the government’s reforms will increase mining activity in Australia by around 5.5 percent.”

The government has stressed that its new tax is based on one of the recommendations contained within the review of the tax system recently conducted by Treasury Secretary Ken Henry. The review contained a series of recommended pro-business reforms aimed at bolstering the international competitiveness of Australian capitalism. On mining, Henry noted that the “current charging arrangements distort investment and production decisions” and said a 40 percent rent tax “would provide a more consistent treatment of resource projects and promote more efficient investment and production outcomes”.

This is why the media has generally backed the Rudd government’s mining tax. And it is why, despite all their efforts to placate the mining executives, Rudd and Swan will not withdraw it. For the Labor government, it is another case of the long-term interests of the Australian capitalist class as a whole taking priority over the immediate sectional interests of one component of the corporate elite.

The author recommends:

Australia: Government unveils pro-business tax reforms

[4 May 2010]