Executives at financial firms bailed out by the government received on average $13.8 million in compensation last year, according to a study of bank earning statements released last week.

Executives at financial firms bailed out by the government received on average $13.8 million in compensation last year, according to a study of bank earning statements released last week.

This figure is 37 percent higher than the average CEO income in the S&P 500, which stood at $10.1 million last year. The study found that CEOs stand to benefit even further after their companies granted them stock options at their low points in early 2009.

The study, published Wednesday by the Institute for Policy Studies, a liberal think tank, gave a comprehensive overview of Wall Street firms’ pay practices based on their proxy earnings statements to the SEC.

The report noted that the average financial CEO’s salary in 2008 was 430 times what an average worker earned during the same time.

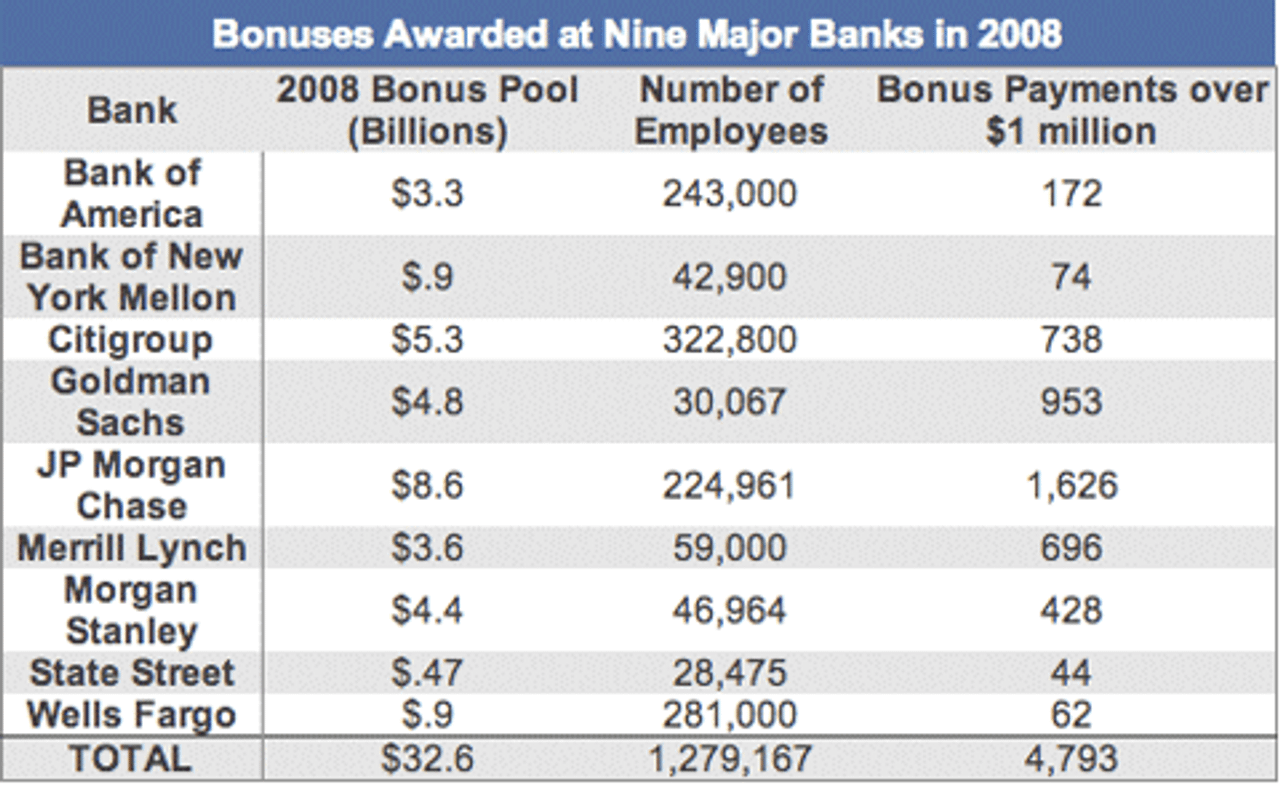

The top five executives at the 20 financial firms that got the most money from the federal government collected a total of $3.2 billion in compensation in the past three years. During this time, these 100 people took in an average of $32 million apiece. This group received $1.2 billion in 2006 and 2007, and $0.8 billion last year.

100 US workers would have to work for a thousand years to make as much as this group made in three.

The report notes that “Executive pay at top US financial firms stands poised for spectacularly rapid recovery.” Many Wall Street firms gave executives large quantities of stock options in the beginning of the year, when stocks were at bottom prices. But as a result of the bailout and the Obama administration’s continued guarantees that it would compensate banks for any losses they incur, these stocks have drastically shot up in value.

Half of the top 20 firms receiving bailouts have already reported the details and valuations of stock options given earlier this year. The top five executives at each of these firms had the value of their stock options increase by a total of $90 million. Executives at JPMorgan Chase had their options grow by $20.6 million, followed by American Express and PNC, each of whose executives had their options grow by $17.9 million. If the rally continues, these people stand to earn far more.

Sarah Anderson, the report’s author, told Newsweek, “I think the most shocking thing was looking at how executives could use the financial crisis as a springboard to an even bigger windfall this year. Rather than hand out bonuses, many companies gave out new stock options. For example, the stock options of American Express’s CEO increased by $18 million, but the stock price of the company was about half since the economic crash. I think this shows that executives come out on top no matter what.”

Executive bonuses are expected to increase by 25 percent this year, according to the Wall Street Journal. Goldman Sachs alone has already allocated $11 billion for employee compensation in the first part of the 2009.

“The federal government has, to this point, not moved forward into law or regulation any measure that would actually deflate the executive pay bubble that has expanded so hugely over the last three decades,” the study concluded.

This is a striking admission, but one that is absolutely true. For all its talk of reigning in executive compensation, the Obama Administration has taken no concrete measures to reduce the actual quantity of funds doled out to executives.

The closest thing to such a measure has been the appointment of Kenneth Feinberg to approve the pay packages of firms receiving some forms of government aid. Feinberg has the power to vote up or down the pay packages for the top 100 employees at these companies. But this limited oversight applies only for companies that still owe the US government money from the Troubled Asset Relief Program.

So far, eight of the top 20 receivers of government funds have paid back their TARP obligations, freeing themselves from any pay oversight. In any case, Feinberg has already approved “in principle” multi-million-dollar bonuses at failed insurer AIG. Feinberg is expected to release the results of his investigation later this month.

In another toothless measure, Congress has mandated that large financial firms conduct non-binding shareholder votes on executive pay packages.

The response from the media has been a mixture of feigned outrage and cynical acceptance. David Weidner wrote in a Wall Street Journal column Thursday, “It’s futile to try and eliminate risk-taking and big rewards on Wall Street. Greed is the nature of the business. Capping Wall Street pay is like telling Apple Inc. to be less innovative or Wal-Mart Stores Inc. to go easy on the discounts.” Instead, he argues that CEO pay should be better aligned with their companies’ interests.

This has been the nominal line of the Obama administration, which has on principle rejected any comprehensive restraints on CEO pay. At the G20 finance ministers’ meeting, which concluded talks on Saturday, France and Germany sought to create some sort of global oversight for pay in the financial industry, but US Treasury Secretary Tim Geithner rejected any such approach, calling instead for token regulations on the amount of capital that banks are required to hold.

It is clear that far from seeking to reign in executive pay, the Obama administration has done everything in its power to defend the exorbitant compensation of the Wall Street CEOs.