Sacked workers from the bankrupt manufacturing company Nylex staged a protest outside the ANZ bank in Melbourne’s central business district yesterday to demand full payment of their redundancy and entitlement money. At least 30 workers from Nylex’s plastics and water-tank plant in Sale, south-eastern Victoria, drove for three hours into the city for the rally. They lost their jobs two weeks ago after the company said it was unable to find a buyer for the plant. Another 30 workers, from a still-operative factory in the outer south-eastern Melbourne suburb of Dandenong, also participated.

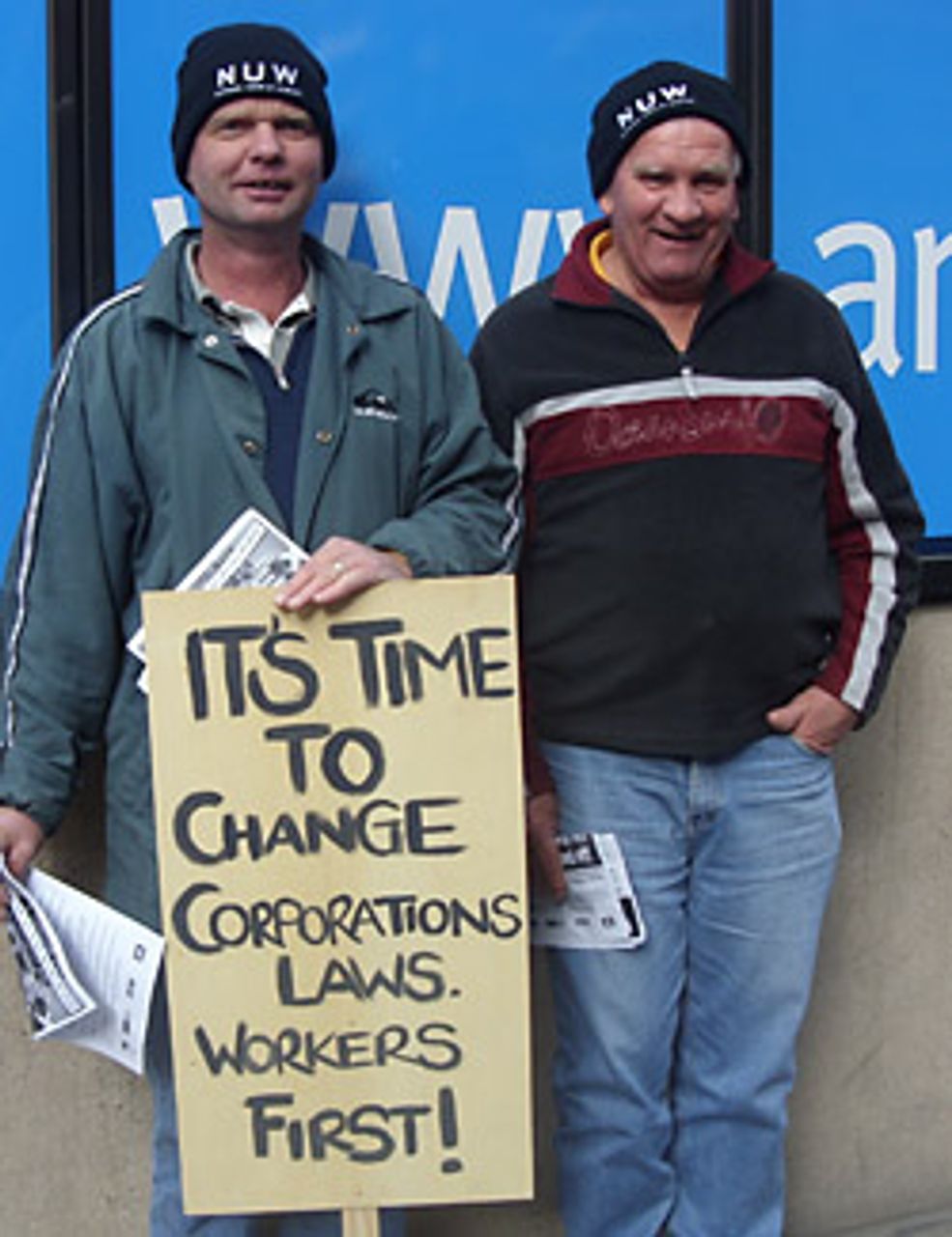

Demonstration of Nylex workers in Melbourne

Demonstration of Nylex workers in Melbourne

Nylex, which manufactures building and industrial products, automotive parts, garden hoses, Esky coolers and other products, went into receivership on February 11, threatening the jobs of the company’s remaining 700 workers. The bulk of the company’s debts—totalling $100 million—are held by the ANZ and Westpac banks. The two banks have priority rights over whatever revenues can be generated through the sale of Nylex assets, potentially withholding workers’ entitlements.

The rally outside the ANZ bank was timed to precede a meeting today between Nylex creditors and ANZ-appointed receivers McGrathNicol and Ferrier Hodgson.

Nylex owes a total of $35 million in workers’ entitlements. This is an urgent issue for the company’s employees, many of whom will now have to pay mortgages, fund their retirement, and look after their families while suffering permanent unemployment. The Sale workers were told last week that they would receive General Employee Entitlements and Redundancy Scheme (GEERS) money covering entitlements accrued since February. However GEERS does not cover unpaid superannuation and several other entitlements. A second payment will be “subject to floating charged assets”, which could mean the workers end up with nothing.

The trade unions have seized on the entitlement issue for their own purposes—stoking up fears that workers will lose out in order to pre-empt any struggle in defence of jobs. In this instance, as with every manufacturing shutdown in Australia over the last two and a half decades, the unions’ priority has been to demonstrate their importance as an industrial police force by delivering to business and government “orderly closures”.

A contingent of trade union bureaucrats from the National Union of Workers, Electrical Trades Union, Australian Manufacturing Workers Union, and Textile Clothing and Footwear Union attended yesterday’s protest. They ensured there were no references to the sackings and no demand that the Sale employees be reinstated. Instead the workers were told to pressure the banks and the Labor government of Prime Minister Kevin Rudd.

In a joint statement that was distributed as a leaflet at the rally, the four unions declared themselves “united in Nylex fight”. Their central demand was for the government to allow them to be more closely involved in the insolvency procedures: “European corporations laws allow for employees and their representatives to be as well informed as banks, directors and other creditors,” their statement explained. “We will be campaigning for the Rudd government to make this important change.”

Textiles Clothing and Footwear Union (TCFU) state secretary Michele O’Neil addressed the rally and declared: “We want the ANZ bank to say ‘well, we will guarantee the workers receive their entitlements in full’. Kevin Rudd and the Labor party promised to protect workers entitlements. We are going to ask them to change the laws to bring back workers getting their rights. A simple change is all that is needed—change the corporation law—put workers before banks.”

She then led a chant of “workers before banks”.

In a revealing episode, as soon as the media had finished covering the protest, O’Neil and her fellow bureaucrats promptly departed, leaving the workers from Sale unsure of what to do or where to go while they waited for their bus home.

The unions’ bogus anti-bank demagogy is designed to cover up the political issues confronting the Nylex workers. Rudd functions as the direct representative of the banks and the major corporations; a struggle by workers in defence of their jobs, entitlements, wages and conditions can only be successfully advanced in conscious political opposition to the Labor government and its agenda.

Moreover, the unions are the proven enforcers of Labor’s agenda. Michele O’Neil’s prominence at yesterday’s protest ought to be taken as a warning to the 700 Nylex workers. The TCFU secretary earlier this year played the key role in preventing any move by 1,200 Pacific Brands workers to defend their jobs. While leading several rallies in February and March, O’Neil promised to fight to overturn the factory closures and mass sackings. But since then virtually nothing has been heard from the union on the issue—underscoring the fact that the TCFU never had any intention of defending the Pacific Brands jobs.

In Nylex’s case, the trade unions have worked hand-in-hand with the company’s executives for years—enforcing factory speed ups, productivity concessions, real wage freezes, and benefit sacrifices, while at the same time striving to conceal the disastrous state of the company’s finances and to play down concerns among workers over pending layoffs.

In February, National Union of Workers (NUW) Victorian Secretary Anthony Thow told the Gippsland Times that despite Nylex going into receivership, the Sale plant was safe and that “at this point workers’ jobs and entitlements were protected”. While NUW legal advisers subsequently worked with the company’s creditors and receivers, the workers were kept in the dark. The Gippsland Times reported June 26: “angry workers weren’t told about the future of the plant for weeks, despite all signs indicating it would close.”

Nylex’s crisis began after high profile CEO and one-time Reserve Bank board member Alan Jackson took control of the company in the late 1990s. He embarked on a reckless expansion strategy, based on amassing debts totalling more than $400 million. The share price skyrocketed and Jackson was hailed in the business press—until 2001, when it became apparent that the company was not making any profits.

Executive Chairman Peter George took over three years ago. Denouncing Jackson’s “debt fuelled spending binge”, he sold off, shut down, and outsourced much of Nylex’s manufacturing capacity. George told the Age in 2006: “The story now is all about catch-up, bringing the company from that sort of 1980s manufacturing view of the world, where it was all about producing goods rather than selling them.”

The administrators were called in earlier this year after the credit crunch hit Nylex’s access to finance and the global economic slump hit sales, especially in the company’s auto parts division. Billionaire Kerry Stokes’s Australian Capital Equity, Nylex’s largest shareholder with a 19 percent stake, sold its entire holdings just hours before trading was suspended prior to the announcement of the corporate collapse. Stokes netted nearly $700,000, while small shareholders were left with worthless stock.

World Socialist Web Site reporters spoke with several Nylex workers at yesterday’s protest.

Laurie Dalton and Earl Smith

Laurie Dalton and Earl SmithLaurie Dalton, from the Sale plant, said: “I’ve been working at Nylex for 23 years. In Sale there’s not that many jobs, they’ve saturated the market for unemployed people. It is going to be a long time before some of these blokes get any jobs. There are lots of young ones in the factory, just starting their families—they’ve got car payments, house payments and they could be unemployed for years. Everyone’s in a bad situation... My wife wants to move down to Melbourne, but I’m not a Melbourne person. I could sell everything I own from where I am, and I’ll be lucky to be able to buy a one bedroom unit in the city—and I would still have to take out a mortgage.”

Laurie spoke about the situation at the shutdown Nylex factory. “We’ve been having productivity increases at the plant for a long time—for about the last five years. They’ve been giving out voluntary redundancies over that time, and other people took over the job of the person who left. We had cleaners before, and now we’re all doing the cleaning as well as being machine operators. They were meant to give us wage increases for doing different jobs, but they never did. When we discussed it with the bosses, we said ‘you said you were going to pay us’, and they said, ‘yes, but if we do we’ll have to lay-off more people’. So, they made us feel that we should be happy that at least we had a job.

“The workers are only being paid the same for doing more work, but the bosses’ wages have increased... I think it’s true that we’ve got to get rid of the system. Kevin Rudd said he was going to change things, he did put in a few things but he didn’t do anyway near enough.

“The business people and the banks run the place and the government. They’ve got all the power... The sad thing is, this is probably going to be the last thing we do before our jobs are taken. At least we’ve gone out to do something.

“We probably did well keeping our jobs for the past five years because we sped the machines up just to keep our jobs. They said, ‘you’re doing well, you’ll get to keep your jobs’—but the thing was that the machines can’t go harder, we can’t go harder. The safety was terrible, we all got injuries, and people hurt their backs and lost parts of fingers. They thanked us for all our work, but now we’re told we’ve got to get another job. Our union was quiet during the last year on all this. The union told us five months ago: ‘Other people are getting nothing at all, so you should be grateful to have your jobs’. We thought, ‘OK, at least we’re getting something’.”

Earl Smith, 62, who has worked for the company for 24 years, is also from Sale. “There are not many jobs available there,” he said. “There are young people with houses to pay for; they’re forced to move to try to get a job. But if you sell a house in Sale, it won’t buy a house in Melbourne.

“I think we need a government to stand up to these people [the banks], and I thought that was what the Rudd government was elected for, not to take orders from the banks the way they are. I don’t reckon the government has any backbone at all. The executives and the bosses shouldn’t be getting more and more money, making more and more money each year. They’re getting more than the prime minister. These blokes think they own the country...

Keith Colston

Keith Colston“This rally should have blocked the whole street off. If it’s going to happen to us, then it’s going to happen to other sections of workers too—maybe a bit down the track, but it’s going to happen to them as well. So we’re all in it.”

Keith Colston works at Nylex’s Dandenong plant. “This has been going on for years,” he said. “Nylex owed about $450 million—every time their profits were no good they got rid of more people and closed down more sections... The workforce went from hundreds to a handful. We used to be working seven days a week. Now we work five days, although we still have three shifts. The workforce has gone down at least 40 percent, and the productivity has gone up. Two of our lines were sold off to Kennon, a joint venture with China.”

Subscribe to the IWA-RFC Newsletter

Get email updates on workers’ struggles and a global perspective from the International Workers Alliance of Rank-and-File Committees.