In the wake of the financial crisis, the British theatre has sought to address the crisis of capitalism. This summer the Soho Theatre mounted a two-week season of short pieces entitled Everything Must Go! Lucy Prebble’s Enron sold out its run at the Royal Court and is transferring to the West End in the spring. The Royal Shakespeare Company will stage Dennis Kelly’s The Gods Weep at the same time.

As significant as the number of plays and the quality of the casts they are attracting, is the fact they are routinely packing theatres out.

The National Theatre commissioned David Hare to write a play about the 2008 financial crash. Hare belongs to an important group of British playwrights radicalised during the 1960s and 1970s. In recent works he has scrutinised aspects of capitalism, from the consequences of the privatisation of British Rail (Permanent Way, 2004) to the Labour government’s colonial conquest of Iraq (Stuff Happens, 2004). Here he finds himself focusing on the capitalist system itself.

Despite his reservations about producing such a play, Hare engaged in serious study. He read extensively on the crisis and worked closely with an economist hired by the National to explain the financial markets, while interviewing economists and bankers.

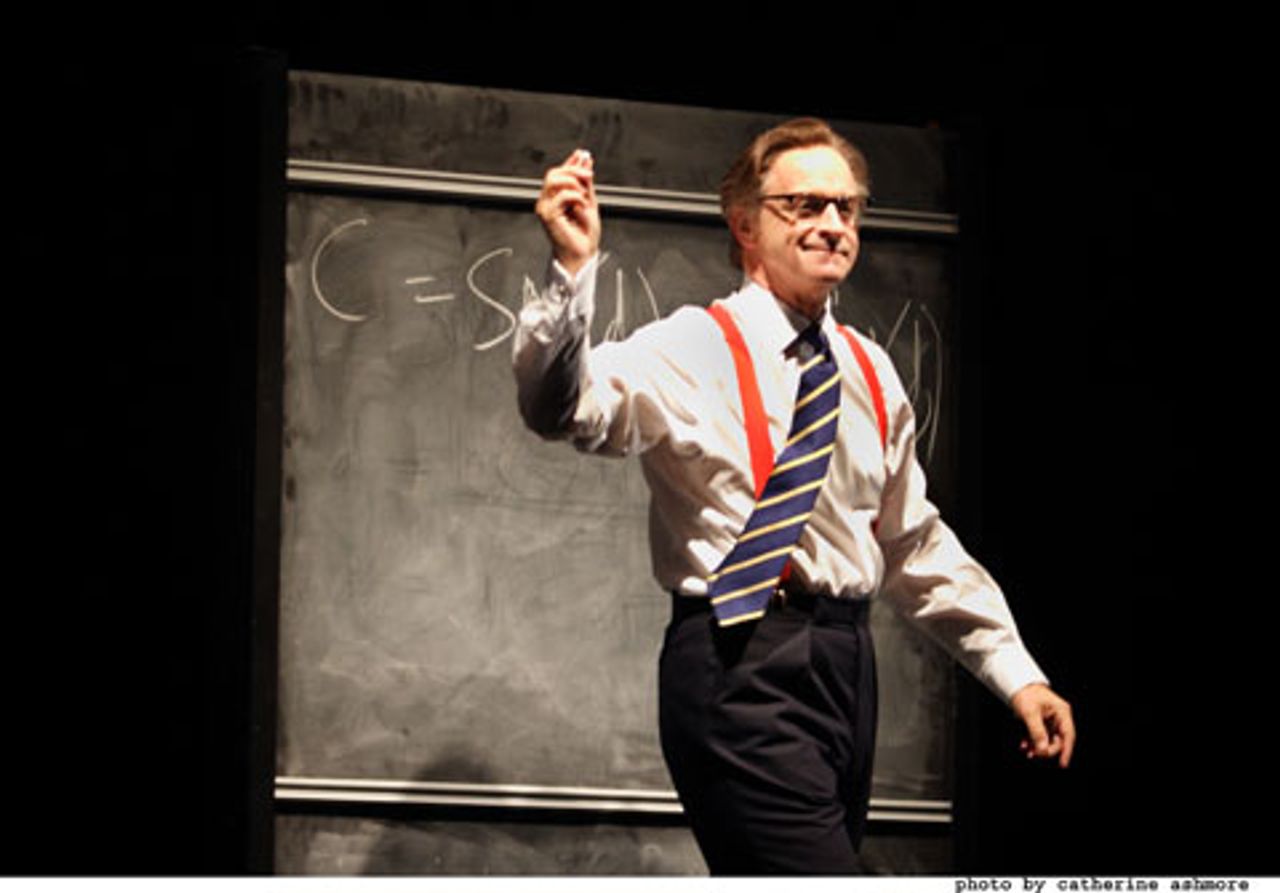

This journey through the financial and political elite and his attempts to understand the crash form the substance of the play. Hare himself is the central character. Guided through the financial world by Masa Serdarevic (Jemima Rooper), his voyage of discovery through the mechanics of capitalism is shared by the audience. Hare is played with the right balance of intelligence, confusion, and outrage by Anthony Calf.

Anthony Calf as The Author

Anthony Calf as The AuthorIn the opening scene he tells the audience, “It doesn’t pretend to be a play. It pretends only to be a story. And what a story! How capitalism came to a grinding halt. Where were you on September 15, 2008? Do you remember? Did you even notice? Capitalism ceased to function for about four days. This summer I set out to find out what had happened.”

In the opening scenes, bankers and financial advisers offer Hare advice on how to write a play. Some try to deter him: a banker says, “By the time your play comes out the whole thing’s going to be over.” The banking crisis will be “interesting as anthropology but not much else. How on earth do you bring to life securitised debt arrangements?”

Some try to push him towards easy villains. George Soros (Bruce Myers) says Hare could write a whole play about Alan Greenspan, who is obsessed with Ayn Rand. Others are overtly hostile to any examination of capitalism. One says that nobody wants to see “political crap,” while a mortgage lender asks him aggressively if he wants “a different system.”

Hare has long resisted the idea that theatre should provide easy answers, and this play certainly does not do so. Its greatest achievement lies in its examination of the ideological and cultural bankruptcy of the financial political elite. A mortgage lender tells him, “Capitalism works when greed and fear are in the correct balance. This time they got out of balance. Too much greed, not enough fear.”

Hare is nevertheless able to point to the deeper-going systemic nature of the economic crisis, and its political implications. He has been criticised in the right-wing press for failing to provide a suitably villainous individual who might divert attention from the systemic collapse of an entire economic and political order. Hare’s portrayal, which is truer to reality, is much more satisfying.

He has said, “The temptation is to treat the financial crisis as though it were an independent phenomenon, a freak event that can only be interpreted in specialist publications or understood by the trained priesthood of the Harvard Business School. But is it a coincidence that the collapse of the financial system was followed, in this country at least, by a collapse of belief in the political system? Is it chance that the luckless victims of the collapse are never its perpetrators?”

Malcolm Sinclair as Myron Scholes

Malcolm Sinclair as Myron ScholesOne such perpetrator was Harvard professor Myron Scholes (Malcolm Sinclair). We see Scholes at a blackboard chalking up his now-infamous formula for pricing options that was supposed to eliminate risk from financial transactions and provide a steady increase in profitability. We move quickly to Scholes receiving the Nobel Prize for Economics. In 1994, Scholes became a hedge fund partner in Long Term Capital Management. After initially reaping enormous profits, they used his mathematical formula to permit borrowing at a ratio of fifty to one. A year later the company “experienced losses which its computers had said were mathematically impossible” and went bust.

Asked if the crisis had affected his views, Scholes insists, “I haven’t changed my ideas.” More than once Hare takes the audience from laughter to incredulity just by quoting the financial elite. Hare probes the cultural decline of the ruling elite through their own observations about themselves. He relates this decline to deep-going economic processes.

One demoralised industrialist tells Hare that this is a world in which people “don’t even know about the past.” He compares it with an earlier period, when the shadow of the Great Depression still loomed over banking. Banking was organised on the principle “debt one third, equity two thirds” because bankers had “a cultural memory about when risk gets out of control.” The new generation has no such memory.

No one could escape the vortex of financial parasitism, regardless of their personal apprehension. Private equity pioneer Ronald Cohen (Paul Freeman) quotes Citibank’s Chuck Prince as saying, “As long as the music’s playing, you’ve got to get up and dance.” The banks, says Cohen, “were all in a dancing marathon.... You don’t dare stop, because your clients will remove their money and take it to another bank which is still dancing. And meanwhile the building is falling down, the roof is open to the sky, the hall’s slipping off the pier....”

The wealth of detail and comment Hare uncovers builds up a compelling picture of a system in collapse.

In a scene about the appearance of Fred Goodwin, the former head of the Royal Bank of Scotland (RBS), before a House of Commons Select Committee, Hare has a financial journalist explain how Goodwin was “angry at the markets for not behaving in what he regards as a rational manner.” Senior banker Lord Freud has said that Hare’s play “captured some of the spirit of the system which no one understood rather clearly.” There is a striking scene where a Bank of England seminar, held to congratulate its top staff for having maintained stability, is interrupted by news of the collapse of Northern Rock.

Hare draws out exactly what Goodwin represented. Soros explains that, prior to the crash, RBS was the biggest company in the world. It had assets of £1,900 billion, when British Gross National Product was only £1,500 billion. These statistics get a big reaction from the audience, but Soros points out that this was just one bank.

Hare notes an important detail of Soros’s own biography, when he states how real the Russian Revolution always was for him, as his father had escaped from it. Soros is ready to exploit the unfolding catastrophe, but he is also conscious of its social impact.

The interview with Soros in his apartment is one of the most powerful scenes in the play. Soros concludes with a comment that “the people who end up paying the price are never the people who get the benefits.” Or, as a Citizens Advice Bureau deputy director (Jeff Rawle) puts it, “In our office we see trouble trickle down. But not wealth.”

Hare indicts the Labour Party for its role in the crisis through the persona and opinions of Labour MP Jon Cruddas (Nicolas Tennant). Cruddas brags about the greatest period of growth in 300 years, saying “Labour bet the ranch on the financial services. And it paid off.”

He admits that Labour was convinced that the unparalleled period of growth meant the suspension of the laws of political economy. New Labour saw this as the end of the old class struggle, seeing it as “An end to history! The rise and fall of epochs is over.” Through Cruddas, Hare shows quite clearly how, as chancellor, Gordon Brown pushed financial deregulation to meet the needs of finance capital.

The “big question,” Hare has said, is “Why do we not have a single politician on the front bench of either big party with the guts to start thinking this thing through?”

I was not the only person who came away from the National Theatre with a profound sense that the entire ruling elite is rotten to the core, indifferent to the social suffering they have produced, and should not be allowed any form of control over society’s wealth. That is a tribute to Hare’s incisive play.