On the weekend of January 8-9, the Socialist Equality Party held a meeting of its national membership in Ann Arbor, Michigan. The opening report was given by David North, the national secretary of the SEP and chairman of the editorial board of the World Socialist Web Site. Today, we are publishing the third and final part of the report. Part one was published January 11 and part two was published January 12.

In the perspectives resolution adopted in August 1988, the International Committee of the Fourth International (ICFI) identified the following critical elements of an emerging revolutionary crisis:

1) The historically unprecedented integration of the world market and the global integration of the process of production, of which the transnational corporation is the institutional expression. This global process intensified the fundamental contradiction between the world economy and the nation-state system.

2) The loss by the United States of its global economic hegemony. This was a historic change that found critical expression in the transformation of the US from a creditor to a debtor nation. The precipitous economic decline of the United States was the basic cause of the deterioration in the living standards of broad sections of the working class.

3) The intensification of inter-imperialist conflict, as both Japan and Europe directly challenged the position of the United States on the world market.

4) The rapid expansion of the economies of the Asian Pacific Rim, which had led to the formation of entirely new detachments of the industrial proletariat. Similar tendencies were in progress in Africa and Latin America. Considered from a global standpoint, this signified an enormous strengthening of the potential economic and social power of the working class.

5) The continued impoverishment of much of the “Third World” and the utter failure of the myriad “development” strategies of the national bourgeoisie in these countries.

6) The destabilization of the post-World War II political order that would flow from the turn by all national contingents of the Stalinist bureaucracy—in the USSR, Eastern Europe and China—to policies of capitalist restoration.

Nearly 17 years have passed since the publication of that assessment. The elaboration of a new world perspective requires that an evaluation be made of the perspective elaborated in 1988. It must first of all be said that a perspective is not a promissory note. It is a prognosis, and, as Trotsky noted, the more concrete the prognosis, the more conditional it is.

As the saying goes, predictions are extremely difficult to make, especially about the future! Those who want the future foretold, with unerring exactitude, should be directed to the nearest oracle.

Yet, having offered these caveats, I believe that the analysis of 1988 has stood up very well. I will begin with the last of the essential elements of the world crisis that were identified by the ICFI in 1988: the destabilizing and revolutionary consequences that we anticipated as a result of the turn by the Stalinist bureaucracies to pro-market policies. Permit me to point out that the warnings made in the perspectives resolution of 1988 (and in other documents of that period)—that the policies being pursued by Gorbachev under the banner of glasnost and perestroika represented a climactic stage in the counter-revolutionary policies of Stalinism—were in stark contrast to the enthusiastic support that the last Soviet leader received from the Pabloite theoreticians.

Ernest Mandel, who had been in 1953 the closest co-thinker of Michel Pablo and subsequently became the principal theoretician of the revisionist movement, hailed Gorbachev as the most brilliant politician in the world, and denounced as “absurd” the claim that his policies were directed toward the restoration of capitalism. Mandel’s protégé, Tariq Ali, went so far as to dedicate a book to Boris Yeltsin. The shortsightedness of the revisionists can be, perhaps, at least somewhat excused by noting that the international bourgeoisie were not all that farsighted in their appraisal of the consequences of Gorbachev’s policies. They all subsequently confessed that they were taken entirely by surprise by the sudden collapse of the Stalinist regimes in Eastern Europe and the USSR.

Reviewing the analysis made by the ICFI of the crisis of the Stalinist regimes, it can be said without fear of refutation that it anticipated the upheavals of 1989-1991—which includes the massive rebellion of students and workers in China that culminated in the Tiananmen Square massacre. What could not be predicted was the immediate political outcome of the crisis of the Stalinist regimes. In the course of this crisis, it became clear that decades of Stalinist repression—directed above all against socialist tendencies in the working class and intelligentsia—had left deep scars in the consciousness of the masses. Little remained of the socialist outlook that had once inspired broad sections of the working class. With the encouragement of the bureaucracies, the mass protests in Eastern Europe and then in the USSR were channeled along pro-capitalist lines. Thus, the initial outcome of the anti-Stalinist rebellions was the establishment of restorationist regimes.

But this does not invalidate the perspective that had been advanced by the ICFI, especially when one considers the broader historical ramifications of the events of 1989 to 1991. What, in the final analysis, led to the sudden dissolution of the Stalinist regimes in Eastern Europe and the USSR? Paradoxically, these regimes proved to be the most ill-adapted to the impact of the very economic tendencies that the International Committee had identified in its analysis of the world economic crisis—namely, the acceleration of economic globalization. It was not the backwardness of the economies of Eastern Europe and the Soviet Union, but rather their increasing complexity that made the framework of autarchic national self-sufficiency increasingly unworkable. But the more these economies sought, under the pressure of necessity, to seek access to the resources of the world market—by expanding trade, encouraging international investment and seeking credit—the more they exposed their artificially protected nationalized enterprises to merciless world economic pressures for which they were ill-prepared.

The initial reaction of the Soviet working class to the pro-market policies of Gorbachev had been a series of highly militant strikes, especially by the miners. Increasingly fearful of a movement to the left by the working class, the Stalinist bureaucracies did all they could to assure that the collapse of their decrepit regimes would place power in the hands of pro-capitalist elements. And in this they succeeded. But the political outcome of the upheavals does not alter the fact that their economic source lay in the explosive economic processes set into motion by globalization.

The question of political form is not insignificant. We are not indifferent to the political consequences of the collapse of the Stalinist regimes. The restoration of capitalism in Eastern Europe, the former USSR and China has had a colossal impact on the development of world politics and, we might add, world economy in the 1990s and the first decade of the twenty-first century. To appreciate the magnitude of the consequences of the restoration of capitalism, we have only to ask what the world would look like today if the events in Eastern Europe, the USSR and China had culminated in political revolutions that placed democratic and socialist working class regimes in power. At the very least, I doubt very much that we would have witnessed the speculative exuberance that fueled the rise of share values on Wall Street and other world equity markets during the 1990s. There is no doubt that the collapse of the Soviet Union increased, at least temporarily, the self-confidence of the American and international bourgeoisie. Particularly for the United States, the demise of the USSR opened up vast new possibilities for the exercise of its military power.

But if we consider the state of world capitalism and the position of the United States within the framework of the other elements of the international crisis identified in the document of 1988, and within the still broader context of the post-Bretton Woods situation taken as a whole, a more realistic picture comes into view. All the elements of crisis to which the ICFI pointed in 1988 persist in 2005. Indeed, they have grown more intense and dangerous.

Viewed historically, the collapse of the USSR did not cure the deep internal maladies of the world capitalist system and create new vistas for its progressive development. Rather, it opened up new areas for the expansion of its fatal malignancies. Far from a diminution in the aftermath of the dissolution of the USSR, the last decade and a half has seen a terrific intensification of the contradiction between the irresistible processes of economic globalization and the immoveable imperatives of the archaic nation-state system. As for the historic conflicts between the major imperialist powers, they have been exacerbated by the collapse of the USSR—whose existence had been one of the factors that, since the end of the Second World War, had restrained the tendency toward conflict between capitalist states. The last decade and a half has also witnessed a further massive growth in the size and power of the Asian working class.

The 1988 document placed great emphasis on the economic decline of the United States and the resulting loss of its hegemonic position. This process has not been reversed during the past 17 years, notwithstanding the attempt of the United States to achieve such a reversal through the use of military power. Indeed, the ever more reckless dependence on violence to achieve its global objectives reflects not only a decline in economic power, but a state of deep disorientation within America’s money-mad ruling elite.

I referred earlier in my report to the breakdown of the Bretton Woods system. This, I explained, was a turning point in the fate of post-war capitalism. The end of a system based on dollar-gold convertibility revealed the limits of the global economic power of American capitalism and set into motion a protracted process of economic decline. An examination of the present economic position of American capitalism, which concentrates on the size of America’s deficits and debts, rather than on the firepower of its military arsenal, clearly indicates that we are now at a very advanced stage of the crisis that opened up with the collapse of the Bretton Woods system in August 1971.

The objective economic indices of US decline

During the past year, increasing concern has been expressed in international financial circles about the state of the American economy—in particular, the massive size of its net international investment position (NIIP) and current accounts deficits, and the impact of these deficits on the value of the United States dollar. The earnestness of the concerns raised by these deficits and the decline of the dollar reflect the recognition that these are not simply American problems. They are world problems.

Even after the passage of nearly 35 years, the world bourgeoisie has not been able to find a stable alternative to Bretton Woods. The prevailing system of floating rates has never been anything more than a series of ad hoc arrangements, perpetually vulnerable to serious turbulence in the world currency exchanges. Before 1971, the US dollar guaranteed world financial stability. Since then, it has been the principal agency of world financial instability. This dangerous situation arises from the fact that the dollar remains, despite the perpetual fluctuations in its value on world currency markets, the major world reserve currency. In relation to this fact, several points must be made.

First, the ultimate significance of currency disorders is that they express fundamental imbalances within a world economy that is fractured by the persistence of the national state. The rational economic organization of world economy would be vastly stimulated by a single, universally valid and stable world currency. This was recognized back in the 1940s by the most farsighted representatives of the bourgeoisie. Franklin Delano Roosevelt toyed with the idea of proposing the establishment of a world currency, which he proposed to call the unitas, and asked his socialistically inclined economic adviser, Harry Dexter White, to work out plans for its realization. But Roosevelt, ever the realist, understood that this particular expression of his instinctive social altruism was not compatible with the interests of American capitalism. The proposal never saw the light of day. Significantly, at the same time, the British economist John Maynard Keynes was developing his own scheme for a world currency, which he called bancor. But without American support, this was what the British would call a “non-starter.” Under capitalism, the national currency functions as the emissary of the bourgeoisie from whose state it is issued. Any correspondence between the national monetary policy of which that currency is a representative and the greater good of the global economy is certainly welcome, but, in the final analysis, not to be counted on.

Second, the United States has realized and continues to realize enormous economic advantage from the privileged position that the dollar has enjoyed since 1947 as the world’s principal reserve currency. To the extent that the dollar is employed as the medium of international financial transactions, and is therefore willingly accumulated by central banks throughout the world, the United States is free from the financial and budgetary constraints that are imposed on all other countries. It is permitted to run current accounts deficits far beyond what would be considered tolerable by any other country. However, even for the United States, there comes a point at which the size of the deficit becomes a matter of concern and even alarm. A trillion in debt here and a trillion in debt there, and suddenly, as the saying goes, one’s talking about real money. Then, even central bankers start to sweat and begin to have sleepless nights worrying about the value of the dollars accumulating in their vaults.

Third, the present dollar crisis comes at a time when the US currency’s global sovereignty faces an historically unprecedented challenge, in the form of the euro. The Nobel Prize-winning economist Robert Mundell recently wrote that the two most important events in world economics during the past half century were, first, the demise of the Bretton Woods system in 1971, and, second, the launching of the euro. For the first time since the end of the Second World War, there exists a currency that is achieving recognition as an alternative to the dollar as a world reserve currency. Already, a substantial and rapidly rising percentage of international financial transactions are denominated in euros. This increases the financial pressures on the United States.

While delusional right-wing maniacs like the columnist Charles Krauthammer hail the emergence of a unipolar world, dominated by the United States, the world financial markets have become, most definitely, bipolar. And while another strategist of American hegemony, Walter Russell Meade, dismisses with contempt the European objections to the war with Iraq, predicts that the United States will deal with the French obstructionists in due course, and then observes sardonically that “revenge is a dish that is best served cold,” he fails to consider that the United States may be obliged to pay for the ingredients that go into that dish in euros.

The eruption of American militarism is deeply connected to these unfavorable economic tendencies. Through the use of military power, the United States hopes to gain geo-strategic advantage that it can use to offset, if not reverse, the decline in its economic influence. However, the cost of maintaining a massive military arsenal and financing its global military operations exacerbate the underlying financial problem. The massive budget deficits contribute to a deterioration of the current accounts deficit, the further weakening of the dollar and the increased attractiveness of the euro as an alternative. During the past three years, the dollar’s exchange rate vis-à-vis the euro has declined approximately 35 percent [See Chart 1]. Thus, the United States is caught in a policy dilemma from which it can find no rational way out.

Chart 1. Number of euros for one dollar (monthly averages), 2001-2004. Source: www.x-rates.com.

Chart 1. Number of euros for one dollar (monthly averages), 2001-2004. Source: www.x-rates.com.In relation to the euro, it must be stated that its attractiveness is of a relative, rather than absolute character. It looks good only when standing beside its ugly big brother. The project of European unity, of which the euro is the product, is riven with internal contradictions.

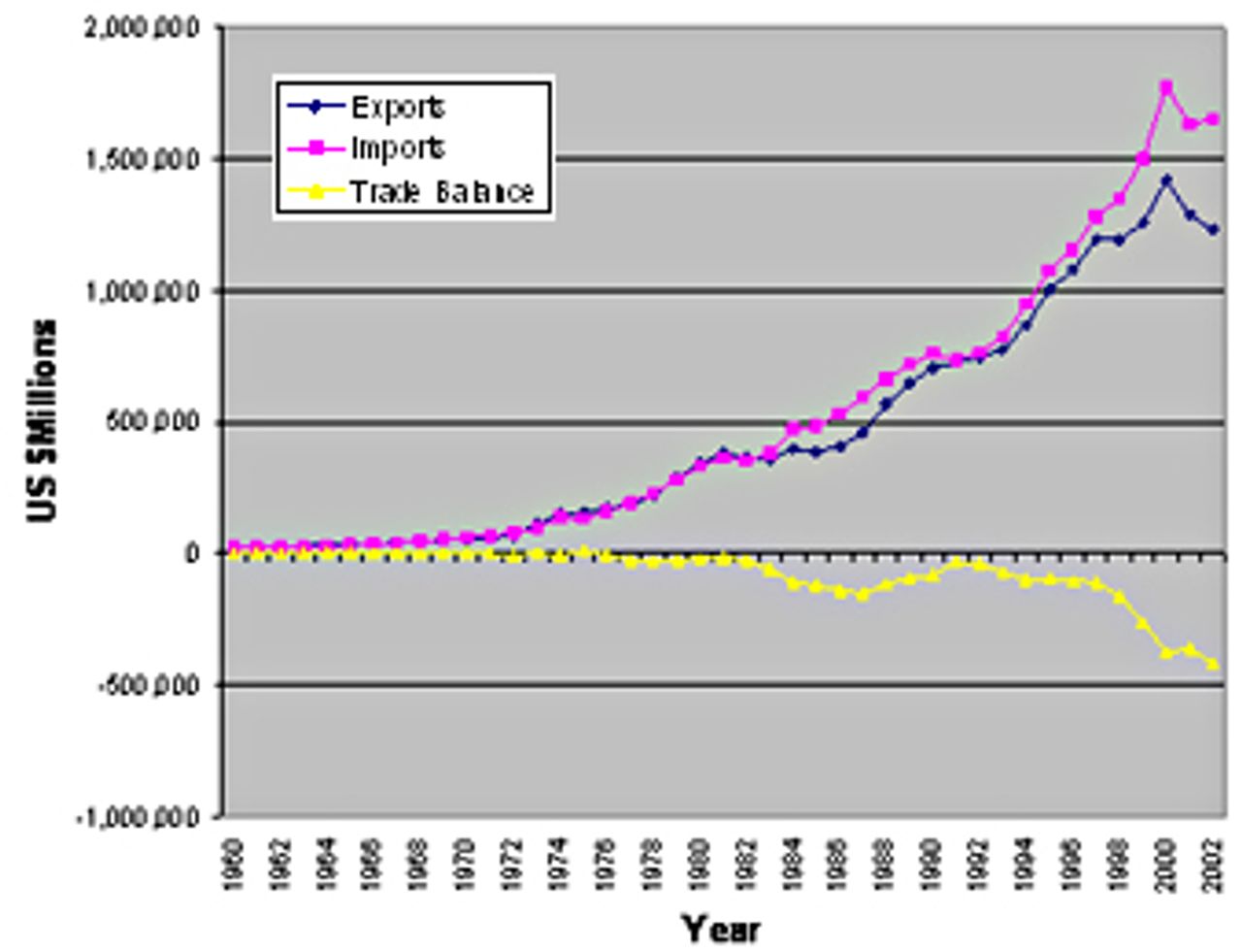

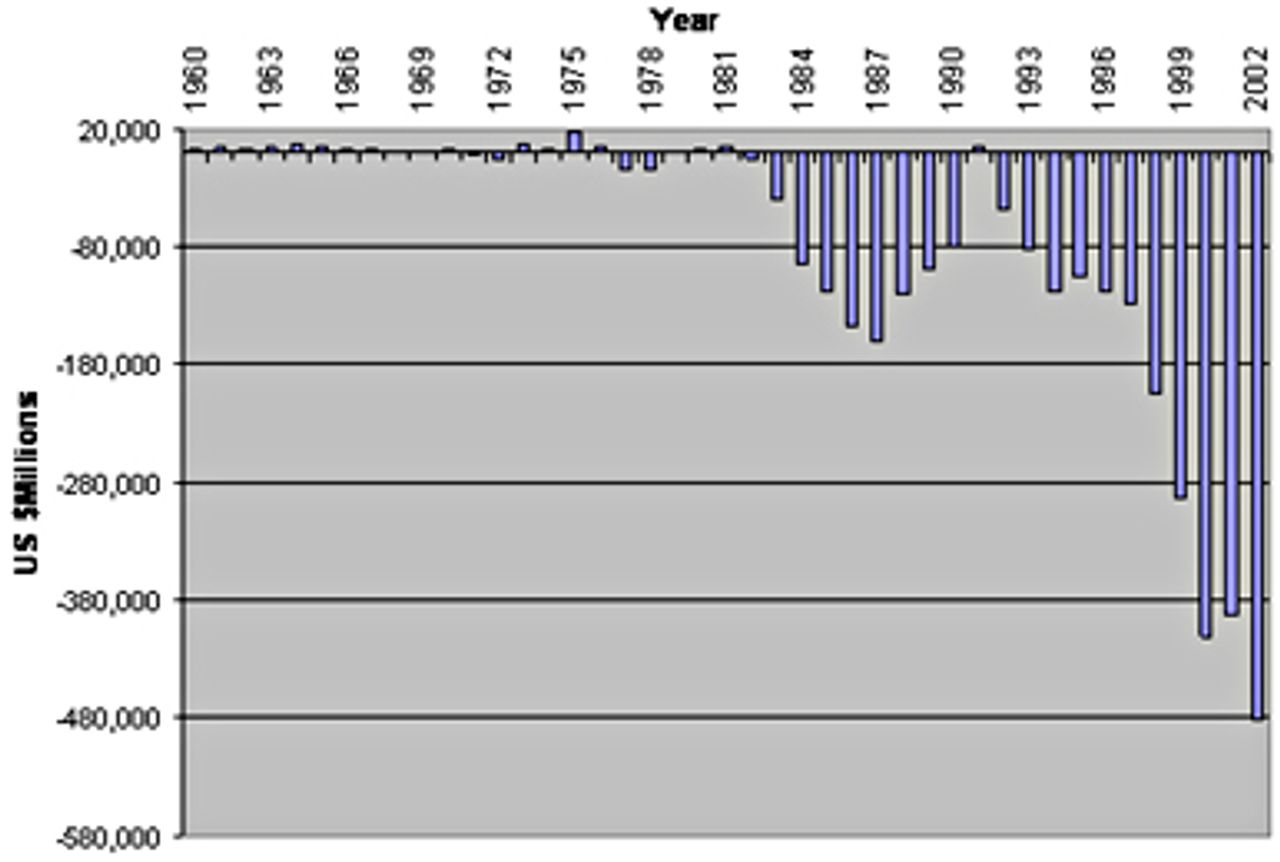

Let us now have a look at the numbers. The trade deficit of the United States totaled $420 billion in 2002. It exceeded $500 billion in 2004. It is expected that the deficit will go well over $600 billion in 2005 [See Chart 2]. The net international investment position (NIIP) of the United States—“the total stock of accumulated foreign claims on the United States (minus debt and equity) minus the stock of US claims on the rest of the world”[1]—has risen from -$360 billion in 1997 to -$2.65 trillion in 2003. We do not yet have the final figures, but it is expected that the NIIP will be in the area of -$3.3 trillion in 2004. This figure represents 24 percent of the gross domestic product (GDP) of the United States. It should be kept in mind that the US NIIP was positive until 1989. As late as 1995, the net international investment position was only -$306 billion. But by the end of 1999 it had reached -$1 trillion. The hemorrhaging is expected to continue. The United States will continue to run huge current accounts deficits, which required that it borrow $665 billion in 2004 [See Chart 3]. No one, with the possible exception of Bush and his immediate entourage, believes that this situation can continue much longer.

Chart 2. US Exports and Imports, 1960-2002. Source: US Bureau of Economic Analysis

Chart 2. US Exports and Imports, 1960-2002. Source: US Bureau of Economic Analysis Chart 3. Balance on US Current Account, 1960-2002. Source: US Bureau of Economic Analysis.

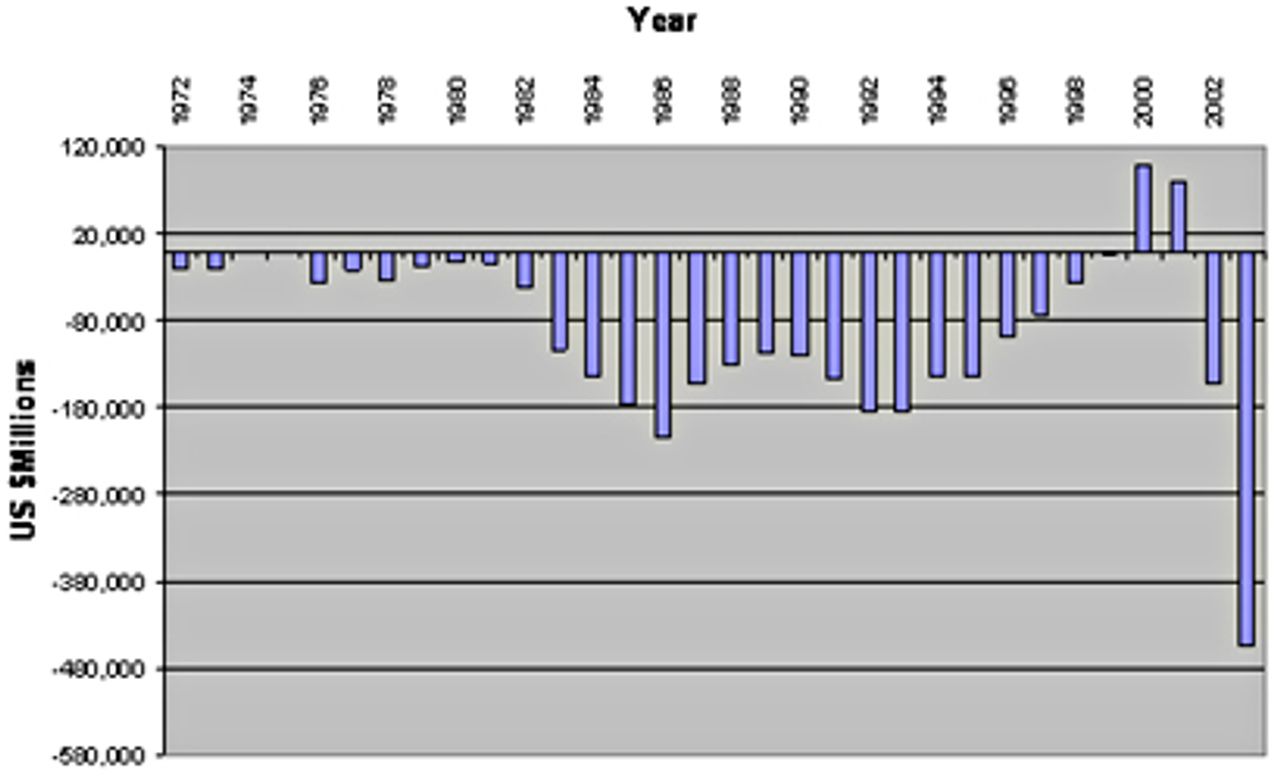

Chart 3. Balance on US Current Account, 1960-2002. Source: US Bureau of Economic Analysis.The current accounts deficit is compounded by the staggering increase in the federal budget deficit [See Chart 4].

Chart 4. US Government Budget Surplus/Deficit, 1972-2003. Source: Congressional Budget Office. Figures from 2003 are projected from July 2003.

Chart 4. US Government Budget Surplus/Deficit, 1972-2003. Source: Congressional Budget Office. Figures from 2003 are projected from July 2003.Permit me to quote from an article co-authored by Treasury Secretary Robert Rubin and noted economists Allen Sinai and Peter Orszag:

“The U.S. federal budget is on an unsustainable path. In the absence of significant policy changes, federal government deficits are expected to total around $5 trillion over the next decade. Such deficits will cause U.S. government debt, relative to GDP, to rise significantly. Thereafter, as the baby boomers increasingly reach retirement age and claim Social Security and Medicare benefits, government deficits and debt are likely to grow even more sharply. The scale of the nation’s projected budgetary imbalances is now so large that the risk of severe adverse consequences must be taken very seriously, although it is impossible to predict when such consequences may occur...

“A loss in confidence among domestic and foreign investors [arising from these deficits] could cause a shift of portfolios away from dollar-denominated assets and put upward pressure on domestic interest rates. These same forces could lead investors and businesses to scale back use of the dollar as the leading world currency for international transactions. That, in turn, could limit the ability of the United States to finance current accounts deficits through dollar-denominated liabilities and thus increase the nation’s net exposure to substantial exchange rate changes.

“The increase in interest rates, depreciation of the dollar, and decline in investor confidence under this type of scenario would almost surely reduce stock prices and household wealth, and raise the costs of financing to business. These effects could then spread from financial markets to the real economy.”[2]

A study published by the Congressional Budget Office (CBO), cited by Rubin, Sinai and Orszag in their report, presented the following doomsday scenario:

“Foreign investors could stop investing in US securities, the exchange value of the dollar could plunge, interest rates could climb, consumer prices could shoot up, or the economy could contract sharply. Amid the anticipation of declining profits and rising inflation and interest rates, stock markets could collapse and consumers might suddenly reduce their consumption. Moreover, economic problems in the United States could spill over to the rest of the world and seriously weaken the economies of US trading partners.

“A policy of higher inflation could reduce the real value of the government’s debt, but inflation is not a feasible long-term strategy for dealing with persistent budget deficits.... If the government continued to print money to finance the deficit, the situation would eventually lead to hyperinflation (as happened in Germany in the 1920s, Hungary in the 1940s, Argentina in the 1980s, and Yugoslavia in the 1990s).... Once a government has lost credibility in the financial markets, regaining it can be difficult.”

In presenting these figures and in citing the opinions of experts, it is not our intention to assert that any of the possibilities suggested in the above quotations must come to pass in precisely the form indicated in the CBO report. One must assume, notwithstanding all evidence to the contrary, that there still exist influential sections of the American ruling elite who are not willing to follow the Bush administration as it heads blindly toward the abyss. Before the current accounts deficit equals 50 or 75 percent of the GDP, and the value of the dollar declines another 30 to 40 percent, on top of the 35 percent decline that it has realized in the last three years, certain powerful sections of the bourgeoisie will intervene to demand a change of course. But what options are available? No matter what alternative policies are proposed, all carry with them serious consequences. Moreover, all alternative policies, not to mention the continuation of the present course, must lead to sharper attacks on the living standards and social conditions of the working class in the United States.

It must never be forgotten that the underlying historical process of which these figures are an expression is the protracted decline of American capitalism. The fate of the dollar is linked inescapably to the productive power and world position of American industry. The disgusting self-enrichment of the ruling elite—indeed, that which makes it so particularly disgusting—is that the money-making process has become increasingly divorced from the real productive capacity of American industry. American capital scours the world for sources of cheap labor and cheap raw materials as the manufacturing base of American industry deteriorates and the living standards of broad sections of the working class either stagnate or deteriorate.

What, then, is our political prognosis? The American ruling class cannot extricate itself from this crisis through peaceful measures, and this applies not only to its policies overseas but within the United States as well. Beyond the borders of the United States, the actions of American imperialism will become even more reckless and brutal. The extraordinary fact that the US government has proclaimed unashamedly that war is an acceptable and appropriate means of achieving geo-strategic aims can only be understood as an expression of an acute awareness that there is no other way for the United States to compensate for the loss of the preeminent position that it enjoyed in the decades that followed the end of World War II.

If America is to maintain its position as the dominant imperialist power, it must secure its access to essential oil and natural gas resources in the Middle East and Asia. Not only that, it must be in a position to have the final word on how those critical resources will be allocated to other major powers—which includes not only Europe and Japan, but also China and India. And, finally, it must see to it that the price of oil is denominated in dollars, not in euros.

But the bloody agenda of American imperialism requires the redirection of critical financial resources away from the social sector of the economy and toward the military sector of the economy. This cannot be achieved without the severe exacerbation of the already significant social tensions that exist in the United States. What can the Bush administration do? There are no good and easy answers. Mutatis mutandis—taking into consideration the evident differences—the situation confronting the Bush administration as it enters the fourth year of its self-proclaimed and bogus “war on terror” is eerily similar to that which confronted the Nazi regime in the late 1930s, on the eve of World War II. As a perceptive historian explained:

“...from [the Nazi] point of view, there seem to have been no problems of economic and social policy in 1938/39 for which unambiguous solutions were ready to hand. The forced preparation for war from early 1938 had overstrained capacity and reserves on every side.... Difficulties...merged into an all-embracing crisis of the entire economic and governmental system; at the heart of it lay the question of how the social product should be divided between military and civil needs. To put it another way, the government was faced with the acute political problem of how much sacrifice they could demand of the people for the sake of rearmament and war.” [3]

If this was a problem in a country where the bourgeoisie had already succeeded in bringing to power the most brutal and ruthless dictatorship the world had ever seen, the political dilemma that confronts the Bush administration is even more acute. Broad popular opposition already exists to the Bush administration. The very fact that it can find no means of expression within the existing political structures imparts to this latent social opposition an exceptionally explosive character.

The task of the Socialist Equality Party must be to base itself on the logic of the world economic crisis, anticipate a renewal of social struggle in the United States and orient itself to the revolutionary force in American society—the working class. To those unfamiliar with the history of social conflict in the United States, from the 1870s to the end of the 1980s, who have grown up and attained maturity in a social environment in which strikes, battles with the police, mass demonstrations and other typical forms of the class struggle as traditionally practiced in the United States for more than a century have been virtually unknown, this insistence upon the revolutionary role of the working class may seem utopian, if not outright strange. But historical experience demonstrates that the quiescence, or, to use more appropriate words, torpor and stagnation of the last decade and a half represent a stark divergence from the basic pattern of American social history.

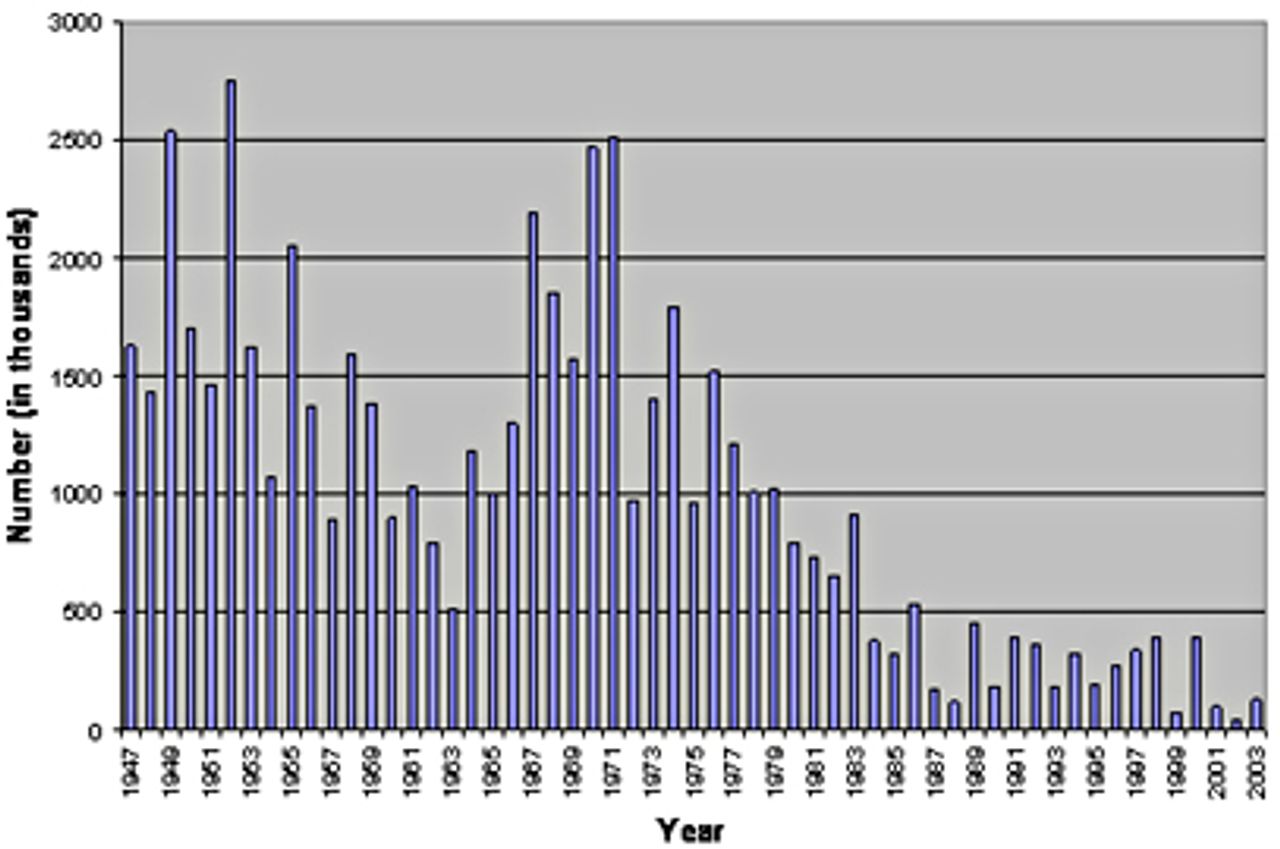

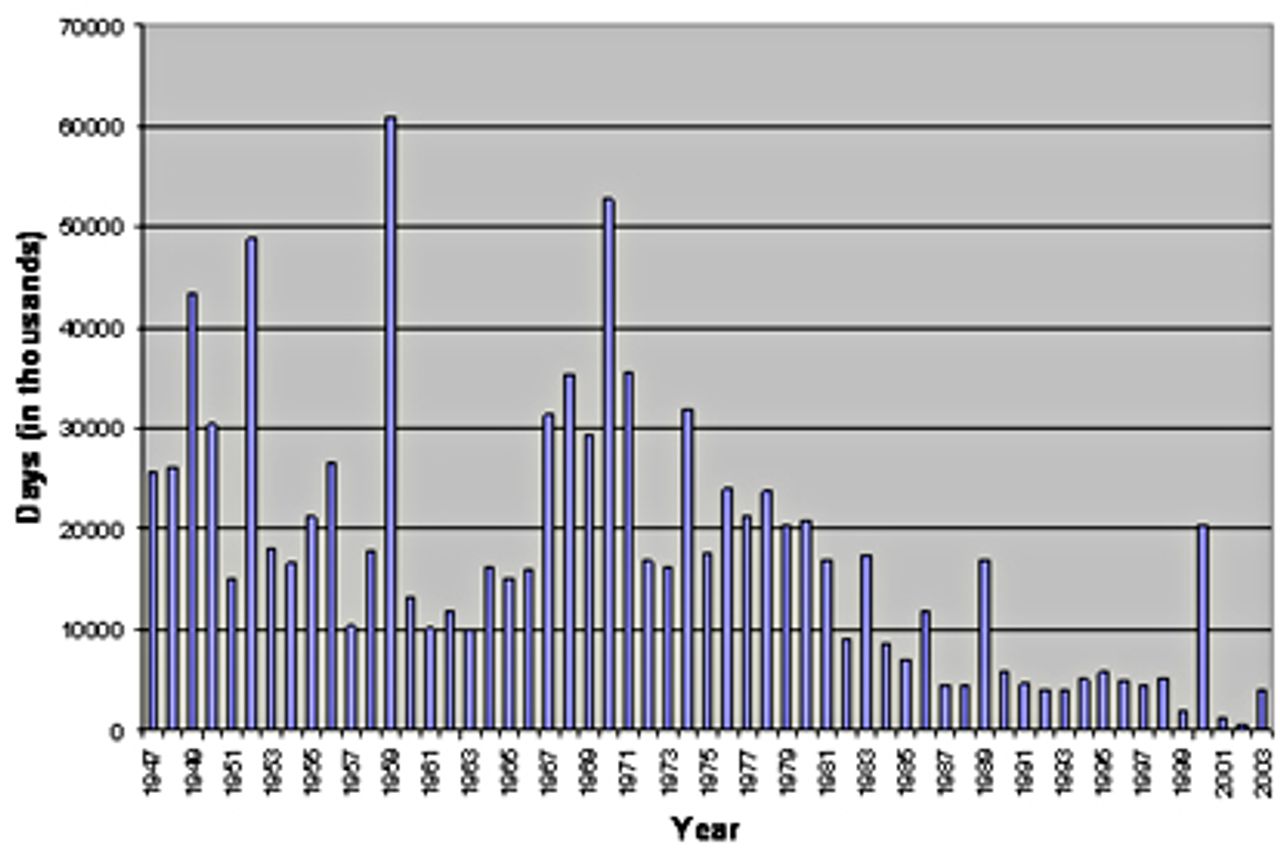

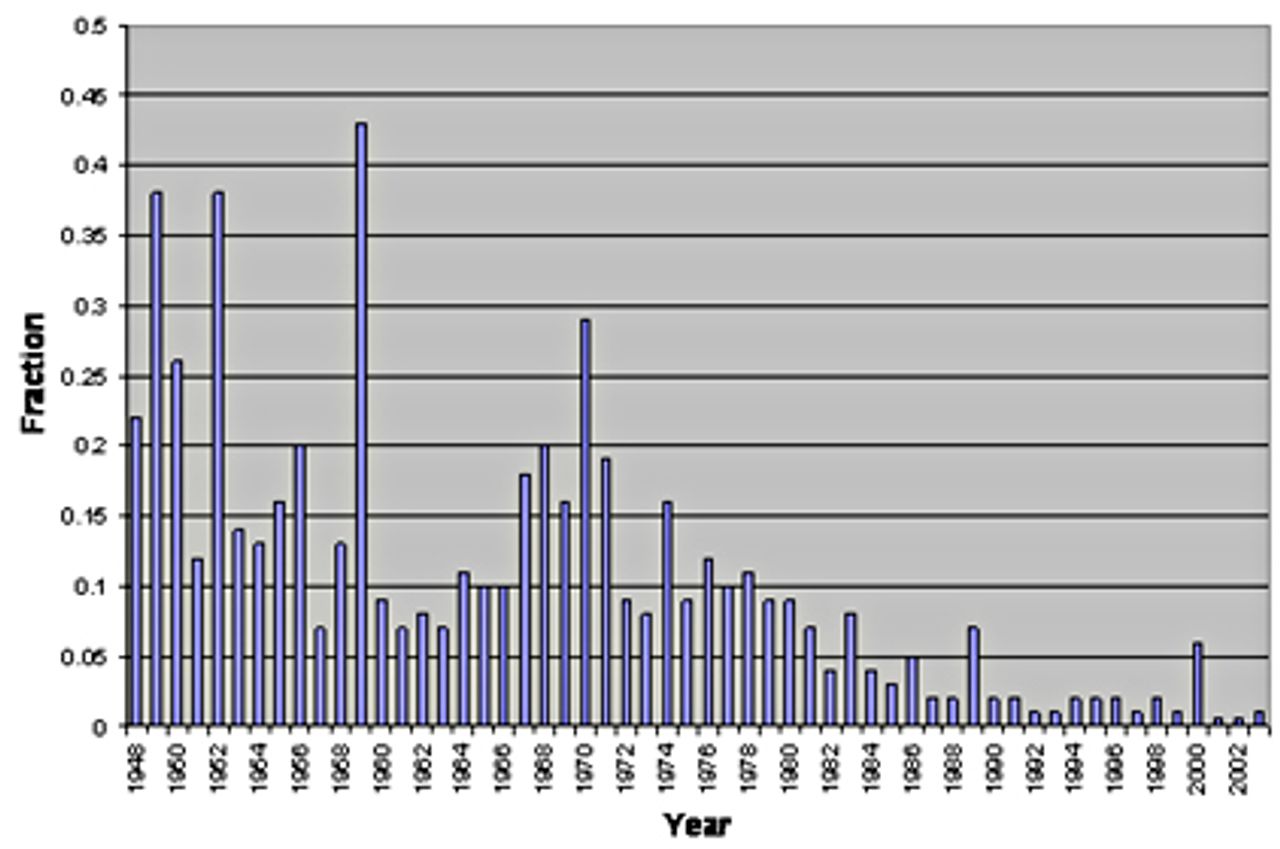

If one studies the most basic indices of class conflict in the United States—strike statistics—one is immediately struck by the virtual disappearance of organized mass job actions during the past two decades [See Charts 5, 6 and 7]. The number of workers involved in stoppages, the number of working days lost and, most important, the percent of total working time lost as a result of strikes have fallen to the point of being virtually insignificant. These figures are utterly atypical of the basic pattern of class relations as they evolved in the United States between the 1870s and 1980s.

Chart 5. Number of workers involved in stoppages involving 1,000 or more workers, 1947-2003. Source: US Bureau of Labor Statistics.

Chart 6. Number of working days idle due to stoppages involving 1,000 or more workers, 1947-2003. Source: US Bureau of Labor Statistics.

Chart 7. Fraction of working time lost as a result of stoppages involving 1,000 or more workers, 1947-2003. Source: US Bureau of Labor Statistics.

What explanation is to be offered for the astonishing decline in the most basic objective indices of social conflict in America? Either the American working class has become entirely indifferent to the decline in its social position, and the vast growth of social inequality during the past two decades has been achieved without in any way contributing to social tensions and fissures in American society, or the existing political structure and forms of organization through which workers traditionally expressed their social discontent have worked to suppress all manifestations of popular working class anger. The latter is a far more plausible explanation. It is also the correct explanation.

The emergence of the working class as an independent and revolutionary political force is not only a matter of organization, but of social consciousness, political perspective and theoretical insight into the laws of history and the capitalist mode of production. During the decades in which it enjoyed substantial influence in the United States, the official labor movement devoted itself to extirpating all traces of these essential intellectual components of class consciousness. Moreover, its national provincialism, combined with slavish devotion to the Democratic Party, precluded any effective response to the capitalist offensive of the 1980s and the new economic conditions created by capitalist globalization.

A renewal of intense social and class conflict in the United States and internationally is inevitable. Our task now is to prepare for the inevitable renewal of class conflict on a world scale by elaborating the international perspective and program upon which the working class must base its struggles, by working energetically to extend the influence of the World Socialist Web Site, by introducing a new generation of youth, students and workers to socialism, and educating them as Marxists on the basis of the incomparable history of the International Committee of the Fourth International.

Concluded

Notes:

1. The U.S. as a Net Debtor: The sustainability of the U.S. External Imbalances, by Nouriel Roubini and Bred Setser (November 2004)

2. “Sustained Budget Deficits: Longer-Run U.S. Economic Performance and the Risk of U.S. Financial and Fiscal Disarray,” January 4, 2004, available at http://www.brook.edu/views/papers/orszag/20040105.pdf

3. Nazism, Fascism and the Working Class, by Tim Mason (Cambridge, UK, 1995), p. 106.